How Do You Make Money Lending Crypto?

1

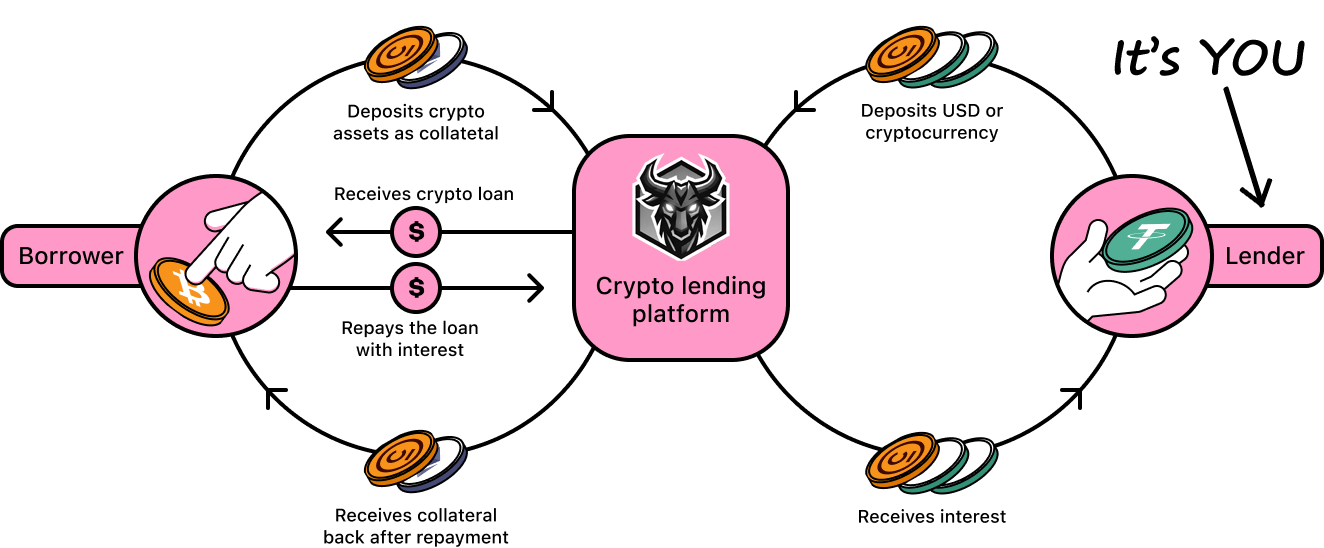

Crypto lending is like lending regular money, but with digital currency instead.

It's part of the DeFi (decentralized finance) world, where you lend crypto to people and get paid interest for it, called "crypto dividends."

2

When people borrow crypto, they use their own digital coins as collateral, just like a house is used for a mortgage.

They lock their crypto while paying off the loan and then get their collateral back. This way, they can use the value of their crypto without having to sell it.

3

Now, how do you make money? Simple! You lend your own crypto coins to borrowers.

You put your coins into a pool managed by a lending platform, and they take care of the rest. They send you interest payments as you lend your coins out.

4

Imagine you have 10 USDT you don't want to sell or trade.

You can lend them on Beast and make some passive income. You could get interest rates up to 6% per year.

5

And don't worry, if a borrower doesn't pay back the loan, the platform can sell their crypto collateral to cover your losses. This way, your investment stays safe, and you keep making money from the interest.

6

So, to sum it up, you lend your crypto coins to others through a platform and get paid interest in return. It's a super easy way to make some extra cash while still keeping your crypto coins.

Discover Your Earning Potential!

Our offer

Monthly Profit

-

Quarter Profit

-

Half a year Profit

-

Year Profit

-

Is Crypto Lending Safe?

Crypto lending on Beast is designed to be safe and secure, especially when lending USDT stablecoins. Although there are always some risks associated with investments, using a reputable platform like Beast and understanding its security measures can help minimize those risks. Here are three reasons why crypto lending on Beast is safe:

Collateral-backed Loans

Borrowers use their cryptocurrencies as collateral for USDT loans.

When borrowers take out a USDT loan on Beast, they provide one of their cryptocurrencies as collateral. This ensures that there's a safety net for lenders in case the borrower fails to repay the loan.

Top-notch Security Measures

Cutting-edge encryption and protection for your funds.

Beast employs advanced encryption algorithms, two-factor authentication, and a secure cloud infrastructure to protect your funds. With Beast's security measures in place, you can be confident that your investments are well-protected.

Active Monitoring & Support

Trust Beast as your guardian throughout your crypto journey.

The Beast platform actively monitors its system and performs regular vulnerability scans to identify and fix any potential weaknesses. This vigilant approach, combined with identity verification and managed services, offers you an extra layer of safety and support during your crypto lending experience.

FAQ

How does Beast Earn calculate interest on my stablecoins?

Beast Earn takes daily snapshots of your balance and calculates the interest earned for that day. We offer competitive interest rates on USDT to maximize your returns.

Can I earn interest on my USDT with Beast Earn?

Yes, you can earn interest on your USDT as it is one of the supported assets on Beast Earn. We offer competitive interest rates to help you grow your investment.

Is it safe to use Beast Earn for crypto lending?

Crypto lending with Beast Earn is designed to provide a secure way to earn passive income on your idle assets. However, as with any investment, we recommend users assess the potential risks and rewards before participating.

Is the interest earned on Beast Earn taxable?

Beast cannot provide tax advice. Users should consult their tax advisers or local tax authorities for guidance.

What security measures does Beast Earn have in place to protect my assets?

Beast Earn uses modern encryption standards, secure cloud infrastructure, web application firewall, DDoS protection, and regular vulnerability scans to ensure the safety of your assets.

Can I withdraw my earnings anytime from Beast Earn?

Yes, you can withdraw your earnings and principal anytime, allowing you to maintain full control over your assets.