Vay Flow.

Vay vốn bằng FLOW.

Đây là Flow?

Flow là một blockchain được tạo ra bởi Dapper Labs nhằm mục đích giúp các nhà phát triển dễ dàng xây dựng các ứng dụng và doanh nghiệp phi tập trung. Flow sử dụng thiết kế kiến trúc đa vai trò để mở rộng mạng lưới thay vì sử dụng sharding. Một trong những lý do cơ bản mà Dapper Labs quyết định rời bỏ Ethereum và xây dựng blockchain đa năng của riêng mình là để tránh sự phức tạp của sharding. Flow khẳng định rằng chiến lược mở rộng mà không cần sharding sẽ cải thiện tốc độ mạng và lưu lượng trong khi bảo tồn các tiêu chuẩn khả năng kết hợp và môi trường thân thiện với nhà phát triển, tuân thủ ACID.

Các khoản vay được hỗ trợ bởi FLOW hoạt động như thế nào

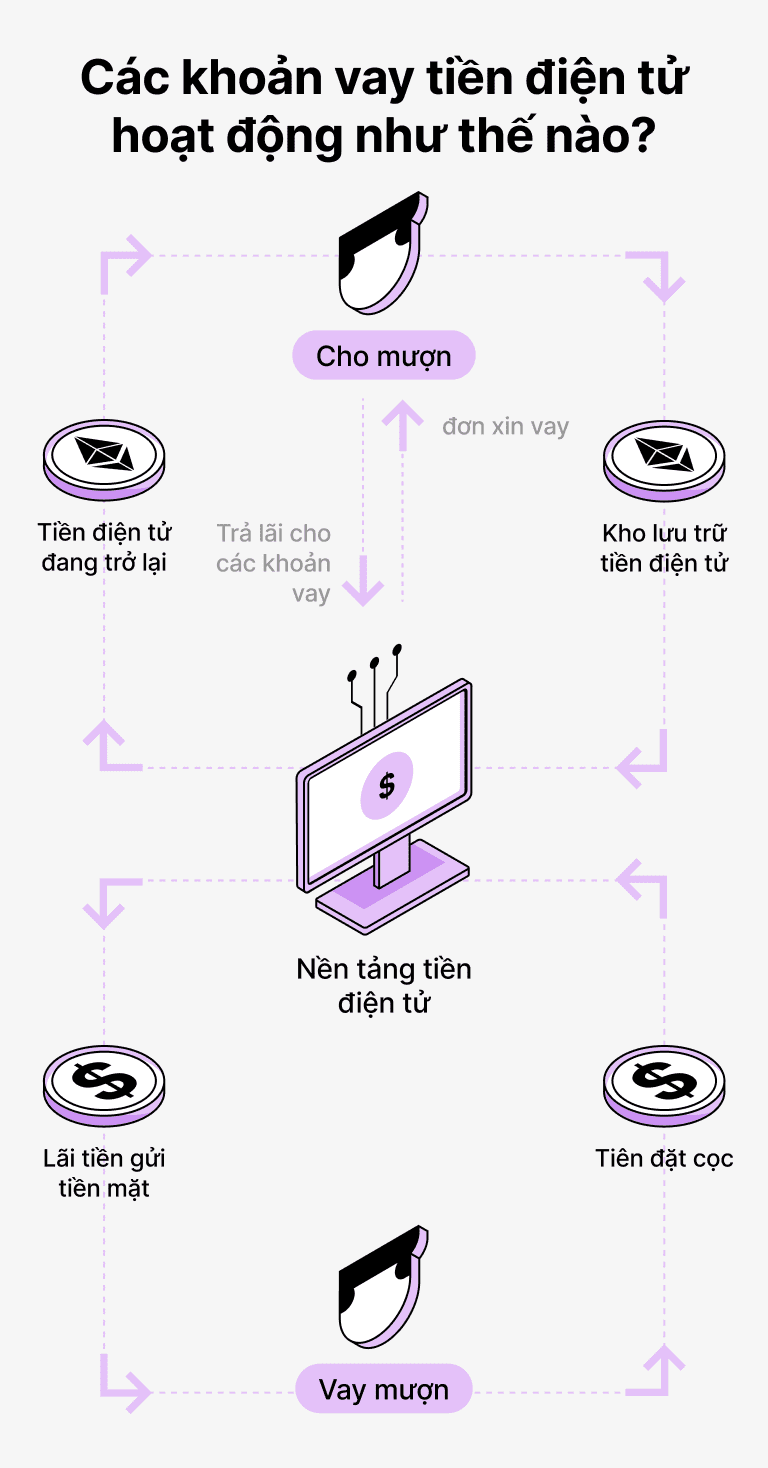

Cho vay tiền mã hóa cung cấp một lựa chọn dễ dàng cho cả người cho vay và người vay. Người vay có thể nhận khoản vay USDT bằng cách đặt tiền mã hóa của họ làm tài sản đảm bảo, cho phép họ giữ quyền sở hữu các tài sản kỹ thuật số của mình. Cách tiếp cận này loại bỏ sự phiền phức của việc kiểm tra tín dụng và các giấy tờ, giúp quy trình trở nên thuận tiện và tiết kiệm chi phí hơn.

Người cho vay có thể đặt tiền mã hóa của họ, chẳng hạn như Flow (FLOW), vào một tài khoản đặc biệt trên nền tảng Beast. Một người giữ tài sản sẽ quản lý mối quan hệ giữa người vay và người cho vay, đảm bảo một trải nghiệm an toàn. Họ hoạt động như một trung gian đáng tin cậy, bảo vệ quyền lợi của cả hai bên.

Người vay tận dụng hệ thống này bằng cách truy cập quỹ mà không cần phải thanh lý tài sản tiền mã hóa của họ. Điều này đặc biệt có lợi trong thời kỳ biến động thị trường, giúp họ tránh được những tổn thất có thể xảy ra. Hơn nữa, mô hình cho vay làm cho việc nhận khoản vay trở nên dễ dàng hơn trong khi không cần phải tiến hành đánh giá tín dụng.

Người cho vay có thể kiếm lãi suất từ tài sản đã gửi thông qua việc hoàn trả khoản vay, cho phép họ thu hồi lợi nhuận từ các khoản đầu tư tiền mã hóa của mình. Điều này tạo ra một thỏa thuận có lợi cho cả hai bên, nơi người vay có được khoản vay, và người cho vay có thể kiếm lợi từ sự tham gia của mình.

Nền tảng Beast quản lý các giao dịch giữa người vay và người cho vay, sử dụng công nghệ blockchain để đảm bảo các giao dịch an toàn mà không cần bên thứ ba. Điều này làm giảm đáng kể khả năng gian lận và thúc đẩy một bầu không khí cho vay đáng tin cậy.

Flow Máy tính khoản vay

Crypto Loans giải thích

Làm thế nào để nhận được khoản vay trên Flow? Vay usd bằng cách thế chấp Flow trên Beast.

Quá trình nhận khoản vay tiền mã độc hại Flow khá đơn giản. Đầu tiên, bạn cần tạo tài khoản của bạn trên Beast, một nền tảng cung cấp dịch vụ cho vay tiền mã độc hại Flow. Sau đó, bạn cần cung cấp FLOW làm tài sản thế chấp và xác định số tiền vay mà bạn muốn. Nền tảng sau đó đánh giá tài sản thế chấp của bạn và cung cấp cho bạn quyền truy cập vào số lượng Tether USDT cần thiết.

Tính tín dụng của bạn được xác định dựa trên giá trị của tài sản đảm bảo của bạn, đồng thời làm cho quá trình vay tiền tiền điện tử nhanh chóng và thuận tiện.

Tuy nhiên, quan trọng nhớ rằng các khoản vay tiền điện tử delloanno không phải là không có rủi ro. Trong trường hợp bạn không trả được vay, tài sản thế chấp của bạn có thể bị tịch thu. Vì vậy, bạn nên đánh giá kỹ khả năng trả nợ của mình trước khi vay tiền điện tử.

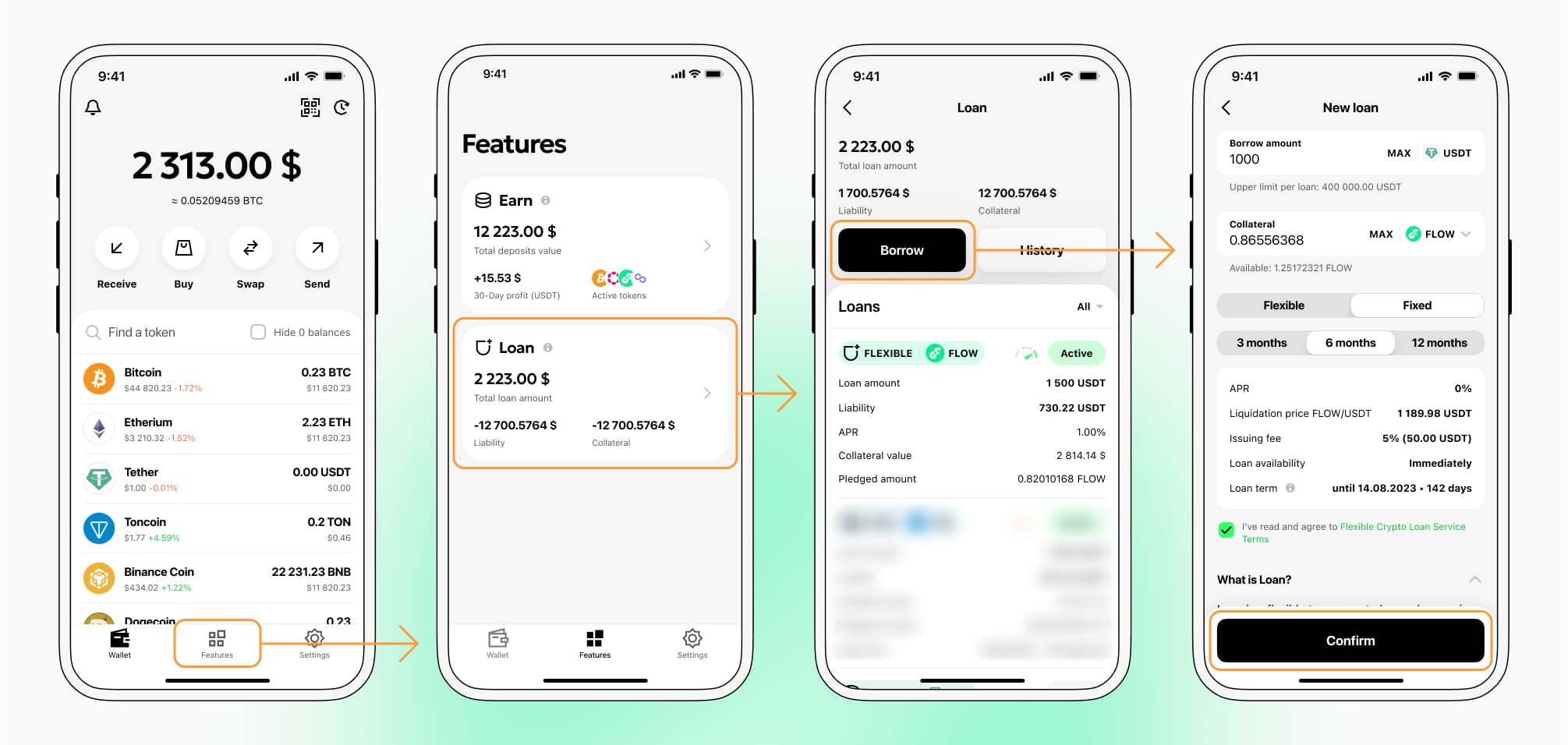

Để xác thực một Crypto Loan của Flow, bạn cần truy cập vào tab Tính năng → Mục vay → Nút Vay

Chọn số tiền vay cần thiết, các điều khoản và điều kiện của khoản vay tiền điện tử, và áp dụng bằng cách xác nhận nó bằng mã từ 2FA - ứng dụng hoặc E-mail hoặc Telegram-bot.

Tìm hiểu thêm về FLOW Crypto Loans

Lãi suất cho các khoản vay được đảm bảo bằng Flow.

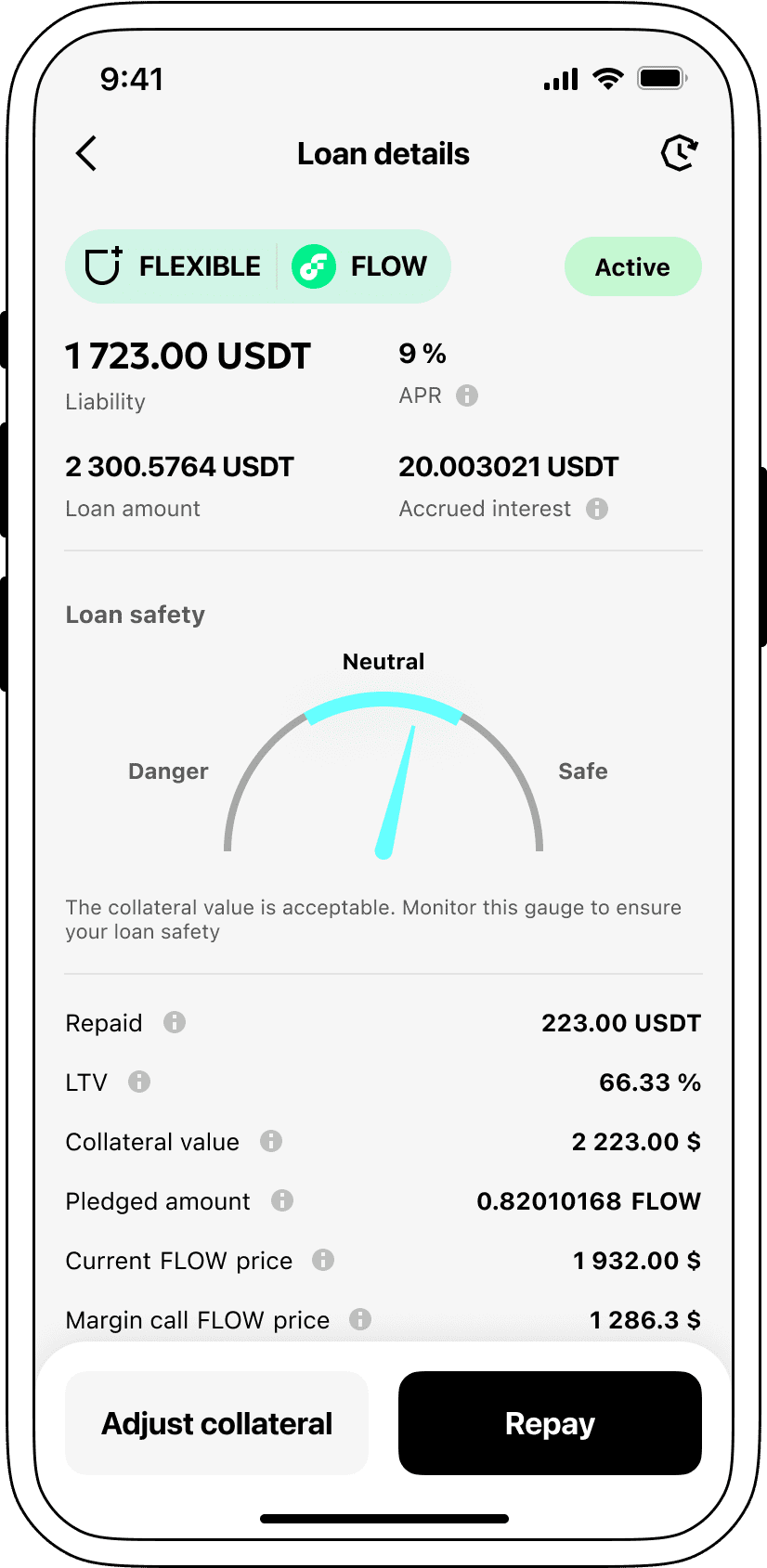

Tại Beast, chúng tôi nhận ra tầm quan trọng của lãi suất cạnh tranh đối với khách hàng của mình. Đó là lý do chúng tôi cung cấp các khoản vay tiền điện tử với lãi suất hấp dẫn chỉ 9%. Dù bạn đang tìm cách huy động vốn cho mục đích cá nhân hay doanh nghiệp, các khoản vay phải chăng của chúng tôi cung cấp một cách thông minh để mở khóa tính thanh khoản mà không cần bán đi những đồng tiền điện tử quý giá của bạn.

Một tính năng nổi bật của các khoản vay tiền điện tử của Beast là quy trình thế chấp của chúng tôi. Nếu người vay không thanh toán khoản vay, tài sản thế chấp trong Flow sẽ ở lại với Beast, trong khi người vay giữ lại Tether USDT đã được cung cấp cho họ. Sự sắp xếp này thúc đẩy một cách công bằng và hợp lý để thu hồi khoản vay, có lợi cho cả hai bên.

Để giảm thiểu rủi ro giá trị của Flow giảm xuống, Beast triển khai hệ thống thanh lý tự động. Nếu giá trị tài sản thế chấp giảm xuống dưới một giới hạn nào đó, khoản vay sẽ được thanh lý. Cách tiếp cận này bảo vệ cả người cho vay và người vay khỏi thiệt hại tiềm tàng trong những lần thị trường bất lợi.

Tại Beast, chúng tôi ưu tiên sự minh bạch và sự dễ sử dụng. Nền tảng của chúng tôi cho phép người dùng theo dõi trạng thái khoản vay của họ một cách dễ dàng qua một giao diện dễ tiếp cận. Người vay cũng có tùy chọn để thêm tài sản thế chấp, thanh toán khoản vay sớm hoặc thanh lý khoản vay bằng cách trả lại số tiền đã vay cùng với bất kỳ khoản lãi nào đã phát sinh.

Nếu bạn đang tò mò về việc vay tiền bằng tiền điện tử, Beast cung cấp các khoản vay coin ngay lập tức. Bạn có thể sử dụng Flow làm tài sản thế chấp để nhận Tether USDT. Các khoản vay có tài sản đảm bảo bằng tiền điện tử của chúng tôi cung cấp một giải pháp nhanh chóng và hiệu quả để đáp ứng nhu cầu tài chính của bạn.

Tại sao chọn Flow Beast Khoản vay

Ofte stilte spørsmål

Đây là gì Beast Flow Vay Crypto?

Làm thế nào để cam kết tài sản của tôi và bắt đầu vay với Beast Flow Crypto Loan?

LTV là gì và tôi có thể vay bao nhiêu từ Beast Flow Crypto Loan?

Có giới hạn cho việc tôi có thể cam kết và vay không?

Loan 'liquidation' có nghĩa là gì và 'Liquidation LTV' là gì?

Khi một khoản vay được thanh lí, điều gì xảy ra?

Margin call là gì?

Tôi có được thông báo khi có những cuộc gọi gửi tiền ký quỹ hoặc thanh lý không?

Lãi suất nào áp dụng cho khoản vay của tôi?

Làm thế nào để tích lũy lãi suất cho vị trí vay của tôi?

Làm thế nào để tôi thanh toán khoản vay hoặc điều chỉnh LTV của tôi?

Bạn có thể thế cú pháp sau vào giao diện của trang web: "Tôi có thể thế chấp hoặc vay các loại tiền điện tử nào trên Beast Crypto Loan?"

Tôi có thể làm gì với tiền điện tử mà tôi được vay từ Beast Flow Crypto Loan?

Thêm đồng xu