Aave loans.

Borrow against AAVE.

What is Aave?

Aave is an open-source and non-custodial protocol to earn interest on deposits and borrow assets with a variable or stable interest rate. It also enables ultra-short duration, uncollateralized flash loans designed to be integrated into other products and services.

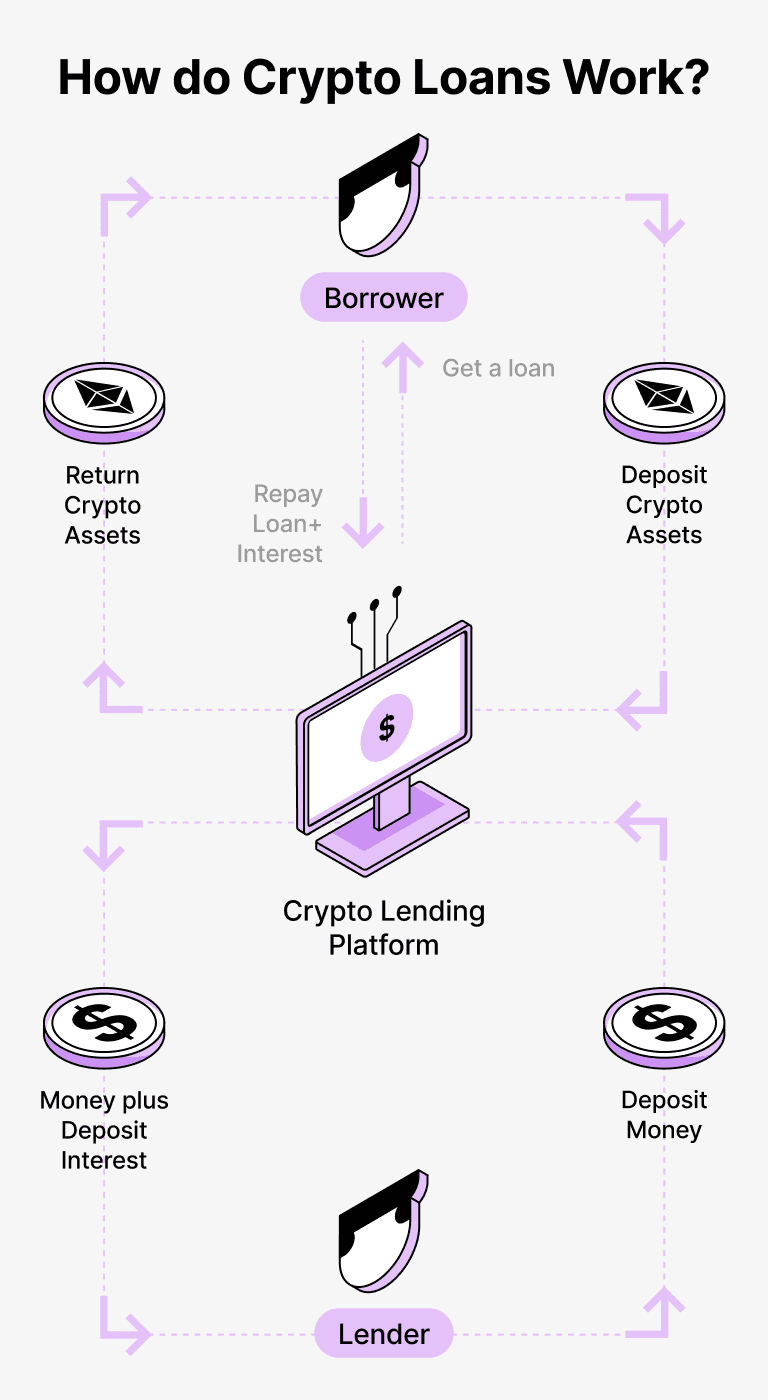

How do loans backed by AAVE works

Crypto-financing provides a straightforward path for both parties involved; those who borrow and those who lend. By using crypto assets such as Aave (AAVE) as a security, borrowers gain access to loans in USDT, all the while retaining their digital asset ownership. This process mitigates the need for extensive scrutiny of creditworthiness and overwhelming paperwork, rendering it both speedier and cost-effective.

On the Beast platform, lenders place their digital currencies like Aave in a designated account. The role of a guardian is important here, who facilitates safe interaction between lenders and borrowers acting as a reliable middleman, ensuring the security of both parties’ stakes.

The system provides a unique advantage to borrowers, letting them avail funds without making a sale on their digital assets. This becomes particularly useful during market volatility enabling borrowers to forestall probable losses. The uncomplicated loan process eliminates credit inspections and thus propels convenient transactions.

Lenders, on the contrary, earn returns on their deposits via repaid loan interest. This not only lets them capitalize on their crypto holdings but creates a beneficial situation for both parties. While borrowers secure loans, lenders perceive gains from involvement.

Through the Beast portal, both lenders and borrowers closely interact under stringent regulations, where blockchain tech ensures secure transactions minus any middle agents. This significantly lowers the chances of deceit and cultivates a secure lending atmosphere.

Aave Loan Calculator

Crypto Loans explained

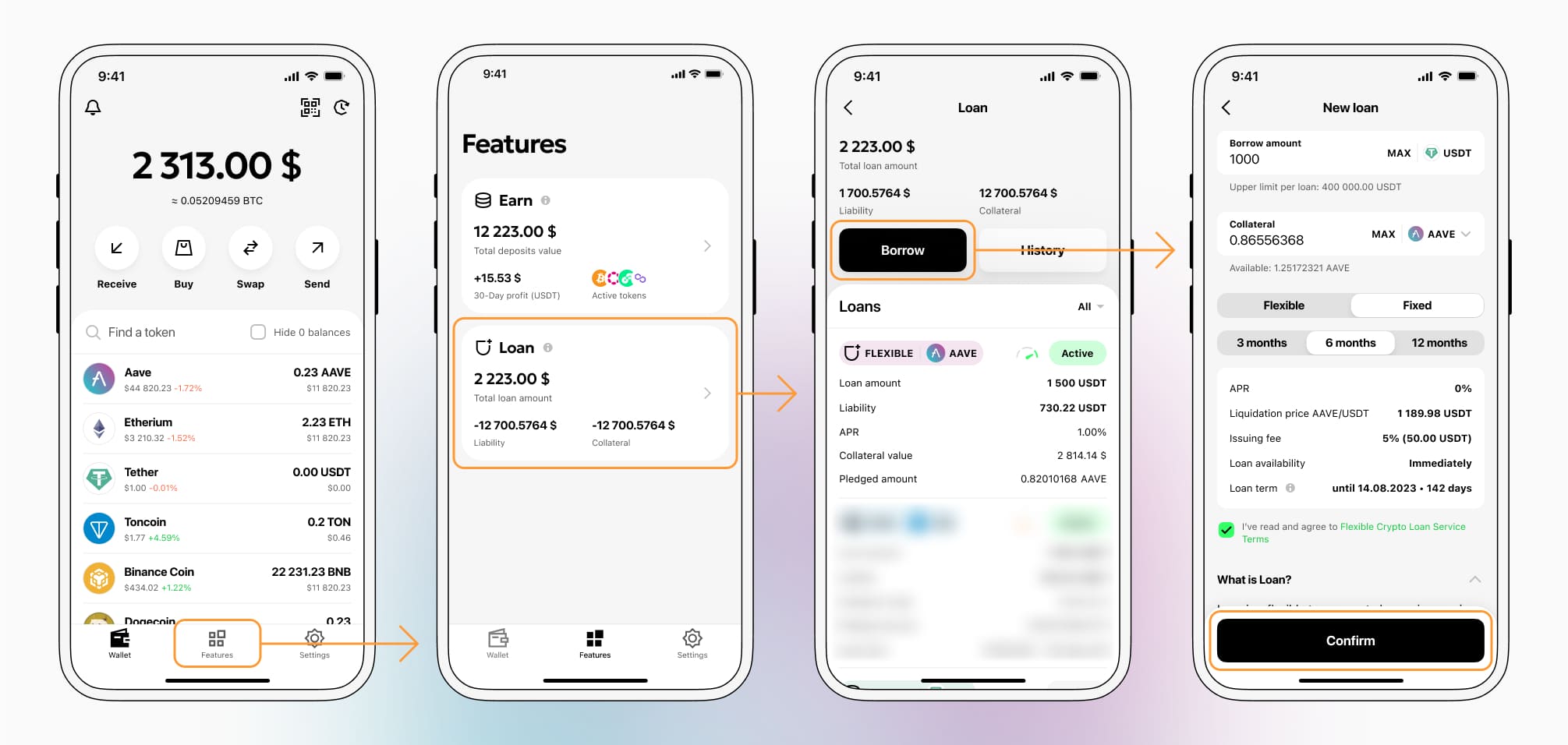

How to get a loan on Aave? Borrow usd against Aave on Beast

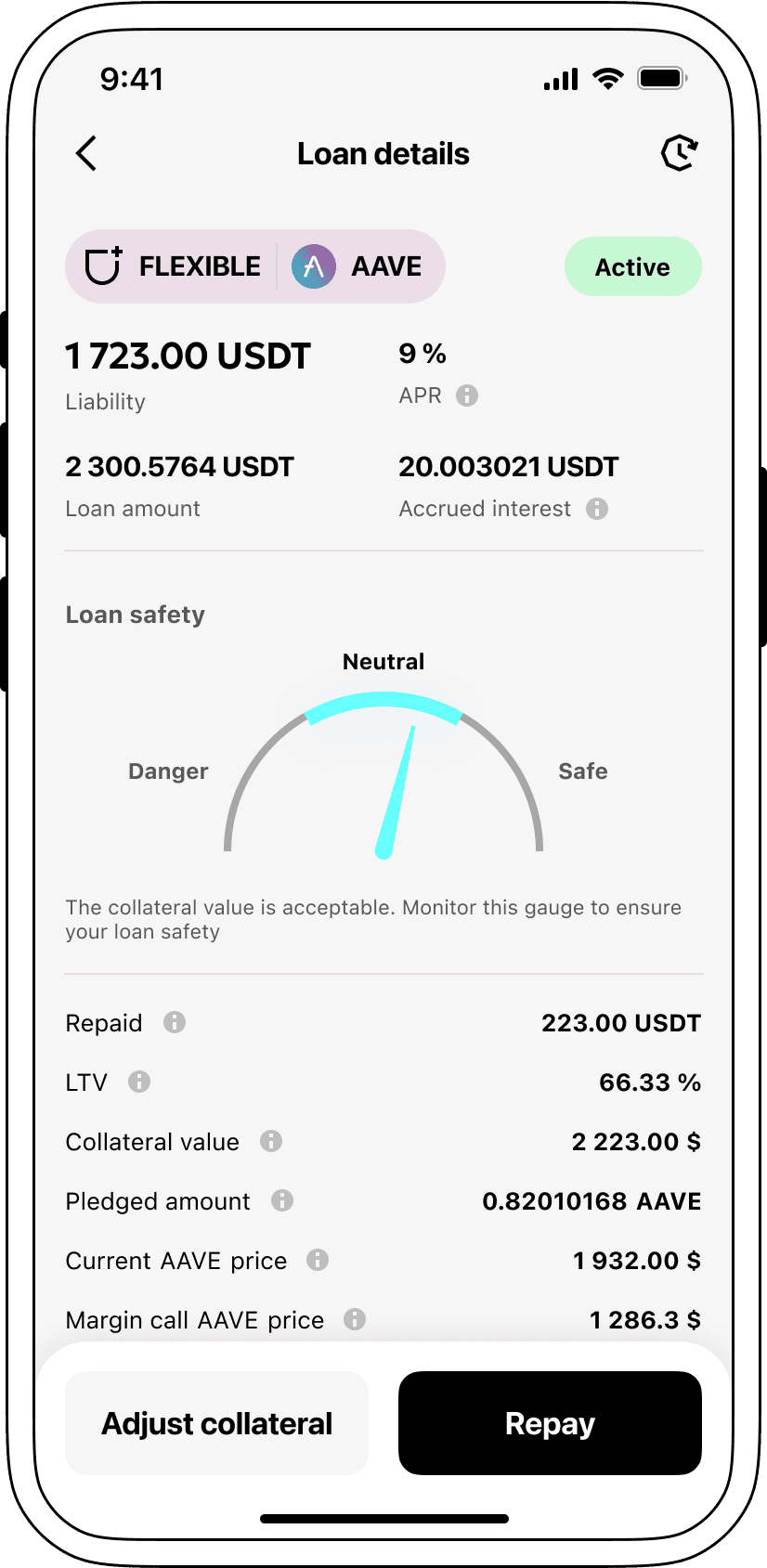

The process of getting an Aave cryptocurrency loan is quite simple. First, you need to create your account on Beast, a platform that offers Aave cryptocurrency lending services. Then, you need to provide your AAVE as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that Aave cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an Aave Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about AAVE Crypto Loans

Interest rates for loans secured by Aave.

Here at Beast, we comprehend the significance of competitive interest rates. That's why we propose loans backed by digital currencies at a strikingly low rate of 9%. Whether you're seeking funding for personal or professional purposes, our affordable loans offer a cost-effective answer; access liquidity without offloading your valuable crypto holdings.

A distinctive element of Beast's crypto borrowing products is the collateral management system. In event of a borrower's default, the pledged Aave stays with Beast, with the borrower retaining the disbursed Tether USDT. This guarantees a fair and equitable method for loan recovery that serves the interests of all involved entities.

Beast combats the risk of Aave depreciation with a preemptive, automatic liquidation function. Should the collateral’s value drop under a critical limit, prompt liquidation of your loan activates. This strategic step safeguards both lender and borrower from potential adverse impacts of market downturns.

At Beast, we value clarity and convenience. Clients can effortlessly keep track of their lending product status via our easy-to-navigate platform. Borrowers enjoy the versatility of topping up collateral, planning early loan settlements, or terminating the loan by settling the borrowed sum and accumulated interest.

Wondering about obtaining a loan via blockchain currency? Beast promptly houses coins as lending collateral. You can pledge your Aave and procure Tether USDT in return. Our blockchain-backed loans offer an efficient, immediate fix for your financial requirements.

Why choose Aave Beast Loan

FAQ

What is Beast Aave Crypto Loan?

How do I pledge my assets and start borrowing with Beast Aave Crypto Loan?

What is LTV, and how much can I borrow from Beast Aave Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Beast Crypto Loan?

What can I do with the cryptocurrencies borrowed from Beast Aave Crypto Loan?

More coins