Cardano loans.

Borrow against ADA.

What is Cardano?

Cardano is an open-source, smart-contract platform that aims to provide multiple features through layered design. Its modularization will eventually allow for network delegation, sidechains, and light client data structures. Cardano uses a version of Proof-of-Stake (PoS) called Ouroboros to secure the network and manage the block production process. The network features a native token called ADA that gives stakers a claim on new issuance in proportion to their holdings and allows users to pay for transactions.

How do loans backed by ADA works

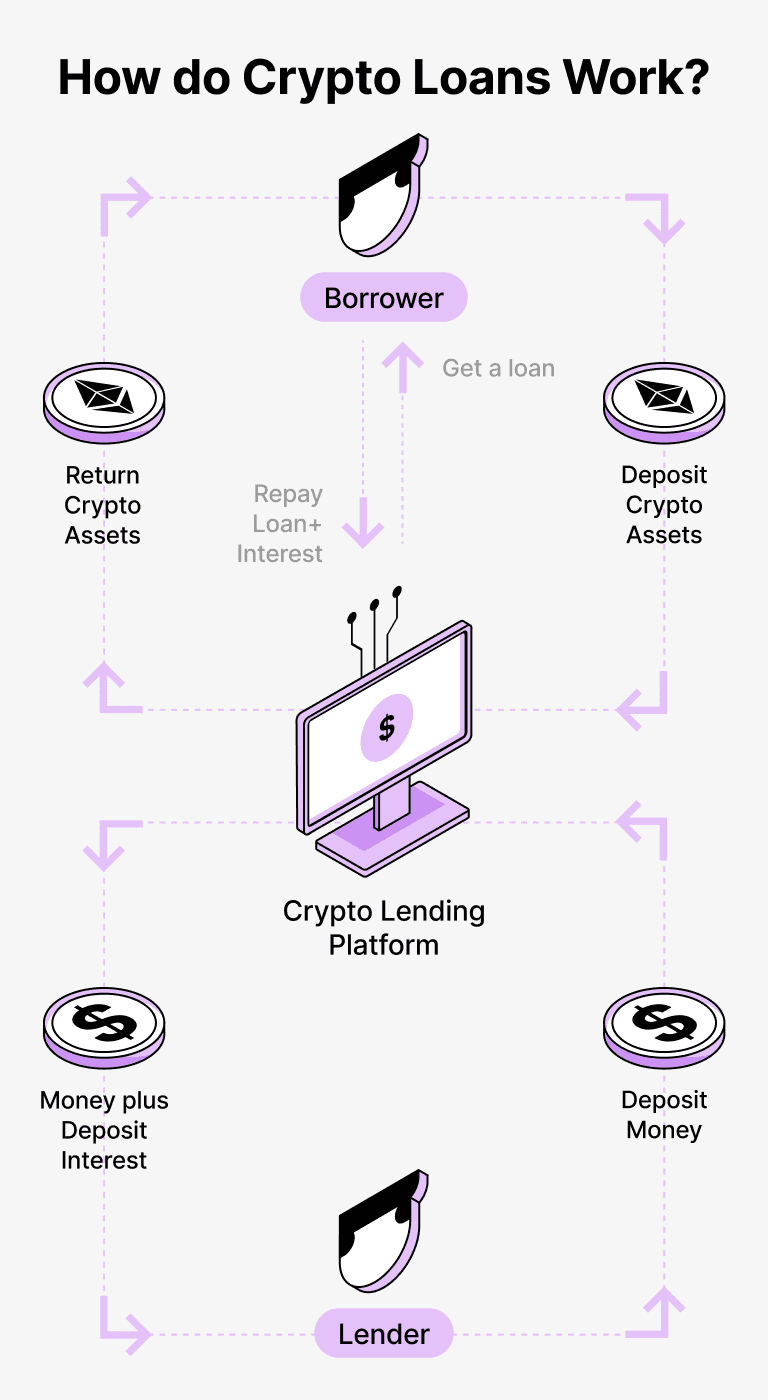

Crypto-credit presents a straightforward solution for both borrowers and those extending the loan. By using their cryptocurrency as collateral, borrowers gain access to loans in USDT, still possessing their digital assets. It removes laborious credit checks and paperwork, streamlining the procedure and presenting a cost-efficient solution.

Those extending loans can store their cryptocurrency, specifically Cardano (ADA), in a unique account on the Beast platform. The platform's custodian plays the role of a watchman overseeing the interaction amongst lenders and borrowers, providing a regulated and secure environment. They function as a reliable go-between, ensuring balanced protection for both parties.

This provision bestows borrowers with the advantage of accessing funds without offloading their cryptocurrency. This proves advantageous, especially in volatile market conditions, providing them with a shield against potential losses. The lending structure further simplifies the process, taking credit checks off the table.

Lenders at the same time gain an interest on their deposited funds via loan repayments. This mechanism lets them garner profits from their owned cryptocurrency assets. It's a perfectly balanced proposition where borrowers obtain requisite loans and those lending the funds gain benefits.

The Beast platform regulates the affiliate relationship between borrowers and lenders, and the inclusion of blockchain technology assures safe transactional operations sans any intermediaries. It substantially decreases possibilities of fraudulent activities, putting forth a secure lending environment.

Cardano Loan Calculator

Crypto Loans explained

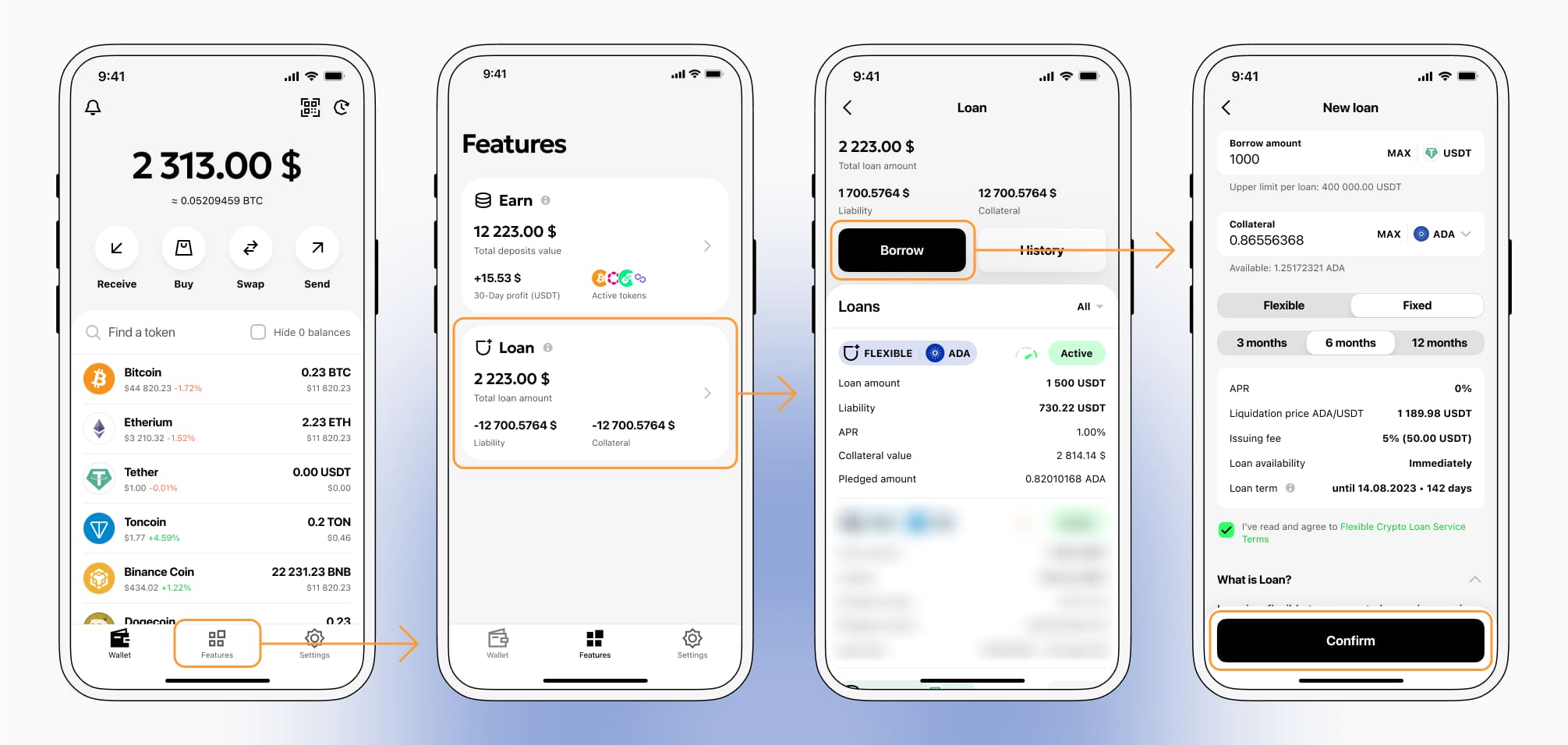

How to get a loan on Cardano? Borrow usd against Cardano on Beast

The process of getting an Cardano cryptocurrency loan is quite simple. First, you need to create your account on Beast, a platform that offers Cardano cryptocurrency lending services. Then, you need to provide your ADA as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that Cardano cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an Cardano Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about ADA Crypto Loans

Interest rates on loans secured by Cardano.

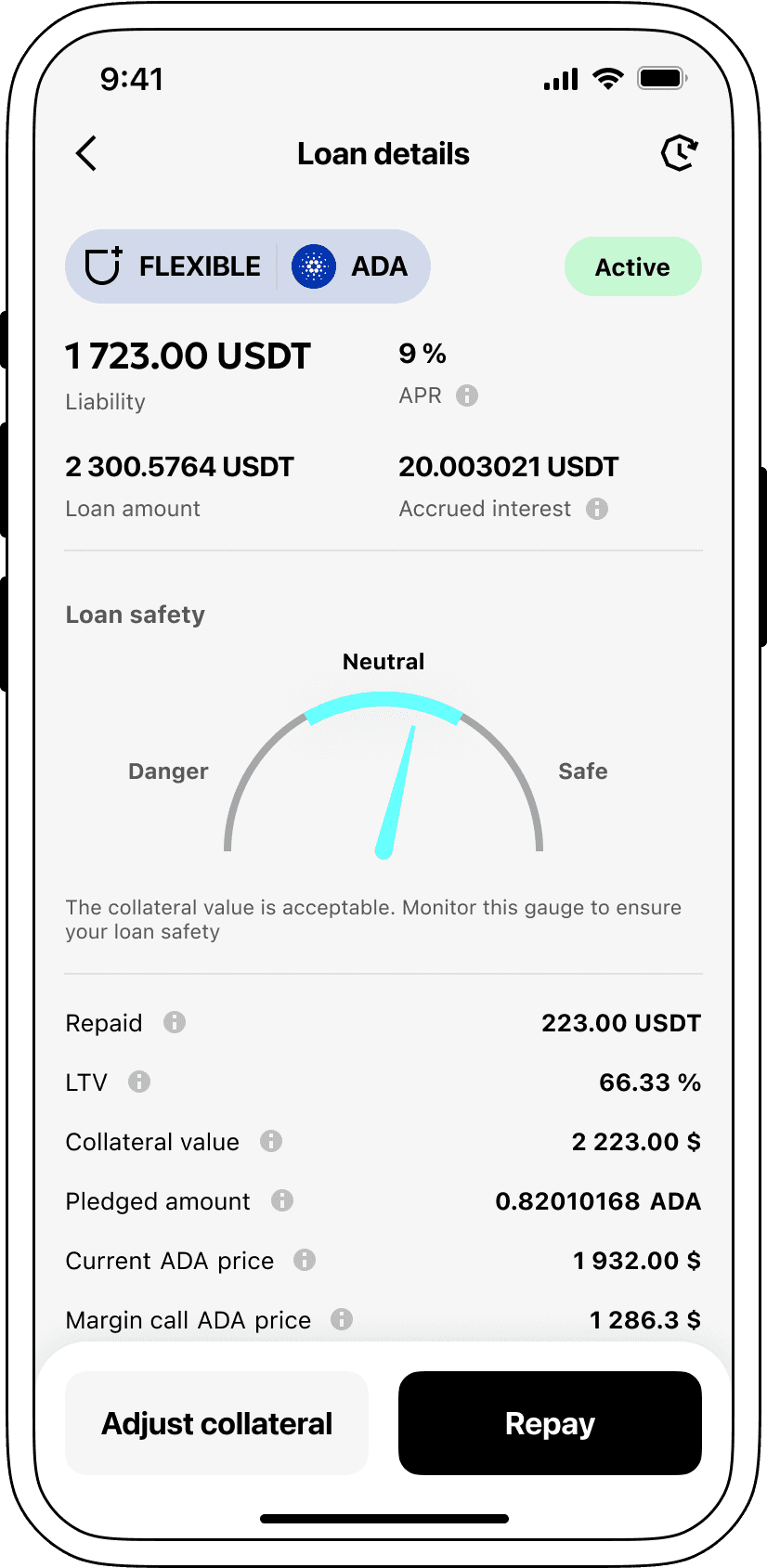

At Beast, we acknowledge that potential loan borrowers are looking for competitive interest rates. As a result, we offer loans secured by digital currencies at a highly lucrative 9% rate. Whether personal or business monetary needs, our cost-efficient crypto loans can grant immediate liquidity without the need to offload your cherished digital assets.

A distinguishing feature of Beast's cryptocurrency loans lies in its collateral procedure. If a borrower is unable to pay off the loan, we keep the security ADA, but the borrower retains the offered Tether USDT. This method guarantees a harmonious loan recovery method, advantageous to all involved parties.

Regarding potential drops in Cardano's value, Beast employs an automated liquidation system. This activates when the pledged asset's value plunges under a certain limit, liquidating the loan. This forward-thinking initiative safeguards both parties, the borrower and the lender, from hefty losses due to market illogicalities.

At Beast, simplicity and openness are highly regarded. Clients can freely track their loan status via our easy-to-navigate portal. Moreover, borrowers enjoy the flexibility to supplement the collateral, prepay the loan, or simply settle the loan by discharging the initial loan amount and accumulated interest.

For anyone considering a digital currency loan, Beast provides prompt coin loans. Here you can secure a loan with Cardano and receive Tether USDT. Our cryptocurrency-backed loans present a prompt and seamless monetary solution, tailored to accommodate your financial needs.

Why choose Cardano Beast Loan

FAQ

What is Beast Cardano Crypto Loan?

How do I pledge my assets and start borrowing with Beast Cardano Crypto Loan?

What is LTV, and how much can I borrow from Beast Cardano Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Beast Crypto Loan?

What can I do with the cryptocurrencies borrowed from Beast Cardano Crypto Loan?

More coins