Litecoin loans.

Borrow against LTC.

What is Litecoin?

Litecoin is a fork of Bitcoin's codebase with four times faster block times and a four times larger supply. The project considers itself complementary to Bitcoin as a silver to Bitcoin's gold. It is often used as a pseduo-testnet for Bitcoin, adopting new protocol changes before they are deployed on Bitcoin.

How do loans backed by LTC works

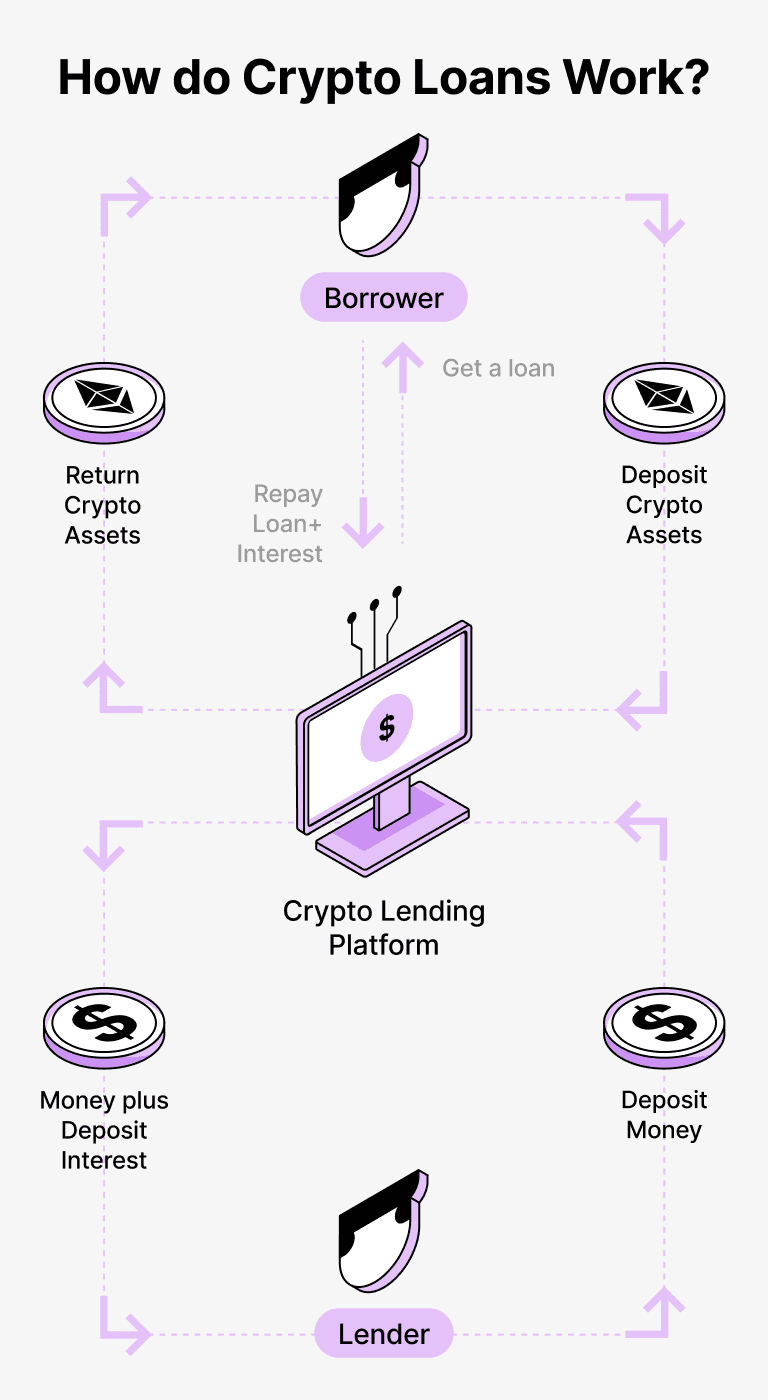

Crypto loans provide an easy option for both borrowers and lenders. Borrowers can secure loans in USDT while using their digital assets as collateral, allowing them to retain ownership of their cryptocurrencies. This process eliminates the hassle of credit assessments and extensive paperwork, making it quicker and more cost-effective.

Lenders can invest their cryptocurrencies, such as Litecoin (LTC), into a specialized account on the Beast platform. A custodian manages the interactions between borrowers and lenders, guaranteeing a safe transaction. They serve as a reliable intermediary, ensuring that the interests of both sides are safeguarded.

Borrowers gain a significant advantage because they can access funds without the need to sell their cryptocurrencies. This is particularly beneficial during market ups and downs, helping them avoid any possible losses. The loan process is streamlined and does not require credit evaluations.

Lenders receive interest on their invested assets through the repayments of loans, allowing them to benefit from their cryptocurrency holdings. It's a mutually advantageous situation where borrowers secure loans and lenders gain returns for their involvement.

Beast's platform controls the dealings between borrowers and lenders, while blockchain technology guarantees safe transactions without the need for outside parties. This decreases the risk of fraud and creates a secure lending atmosphere.

Litecoin Loan Calculator

Crypto Loans explained

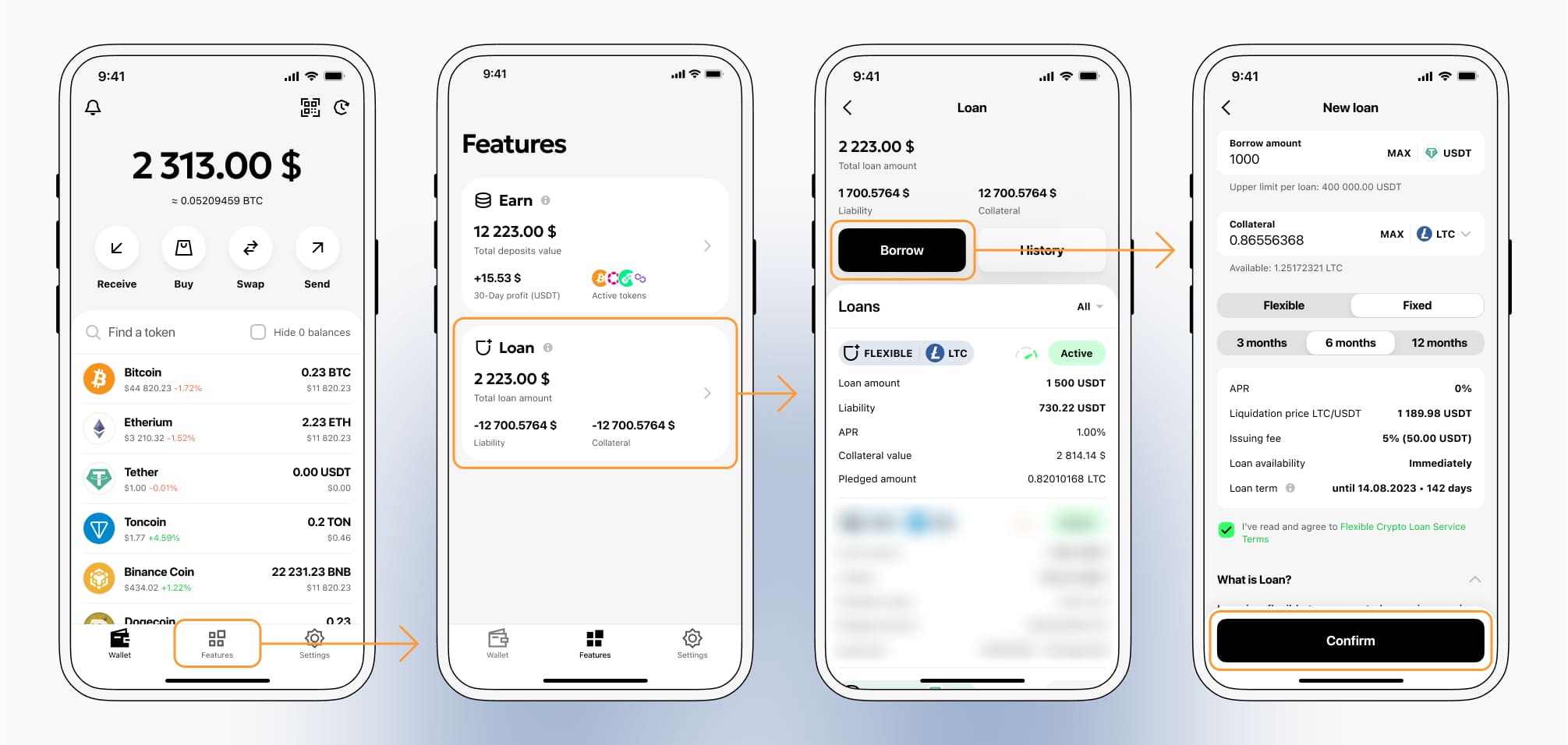

How to get a loan on Litecoin? Borrow usd against Litecoin on Beast

The process of getting an Litecoin cryptocurrency loan is quite simple. First, you need to create your account on Beast, a platform that offers Litecoin cryptocurrency lending services. Then, you need to provide your LTC as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that Litecoin cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an Litecoin Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about LTC Crypto Loans

Interest rates for loans secured by Litecoin.

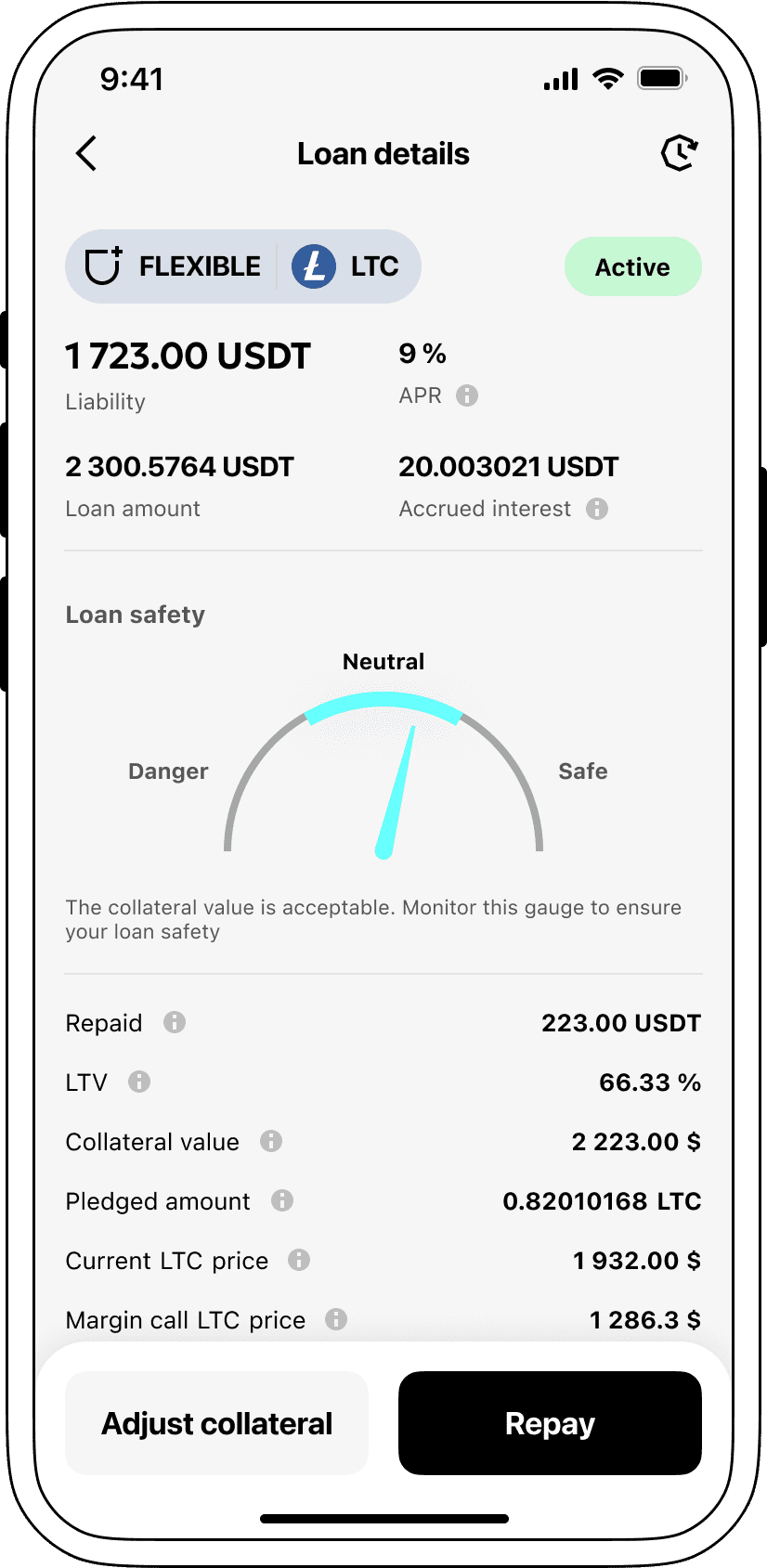

At Beast, we recognize the significance of attractive interest rates. That's why we provide loans backed by cryptocurrency at a remarkable rate of just 9%. Whether you're seeking funds for personal plans or business growth, our low-rate loans present an affordable way to access liquidity without the need to part with your valued cryptocurrencies.

A standout feature of Beast's crypto loans is our collateral process. If a borrower defaults, the collateral in Litecoin (LTC) stays with Beast while the borrower retains the Tether USDT they received. This creates a fair framework for recovering loans that benefits everyone involved.

To mitigate the risk of Litecoin losing value, Beast implements an automatic liquidation system. Should the value of the collateral dip below a set level, the loan will be liquidated. This proactive strategy safeguards both lenders and borrowers from potential financial setbacks during market declines.

Beast prioritizes transparency and user convenience. Our clients can effortlessly track their loan status via our easy-to-use platform. Moreover, borrowers have the flexibility to add more collateral, pay off their loans early, or settle outstanding balances along with any accumulated interest.

If you're curious about obtaining a loan with cryptocurrency, Beast offers instant coin loans. You can use Litecoin as collateral and receive Tether USDT in return. Our crypto-backed loans are a fast and efficient solution for your financial requirements.

Why choose Litecoin Beast Loan

FAQ

What is Beast Litecoin Crypto Loan?

How do I pledge my assets and start borrowing with Beast Litecoin Crypto Loan?

What is LTV, and how much can I borrow from Beast Litecoin Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Beast Crypto Loan?

What can I do with the cryptocurrencies borrowed from Beast Litecoin Crypto Loan?

More coins