Avalanche loans.

Borrow against AVAX.

What is Avalanche?

Avalanche is an open-source platform for launching decentralized finance applications and enterprise blockchain deployments in one interoperable, scalable ecosystem. Developers who build on Avalanche can create applications and custom blockchain networks with complex rulesets or build on existing private or public subnets.

How do loans backed by AVAX works

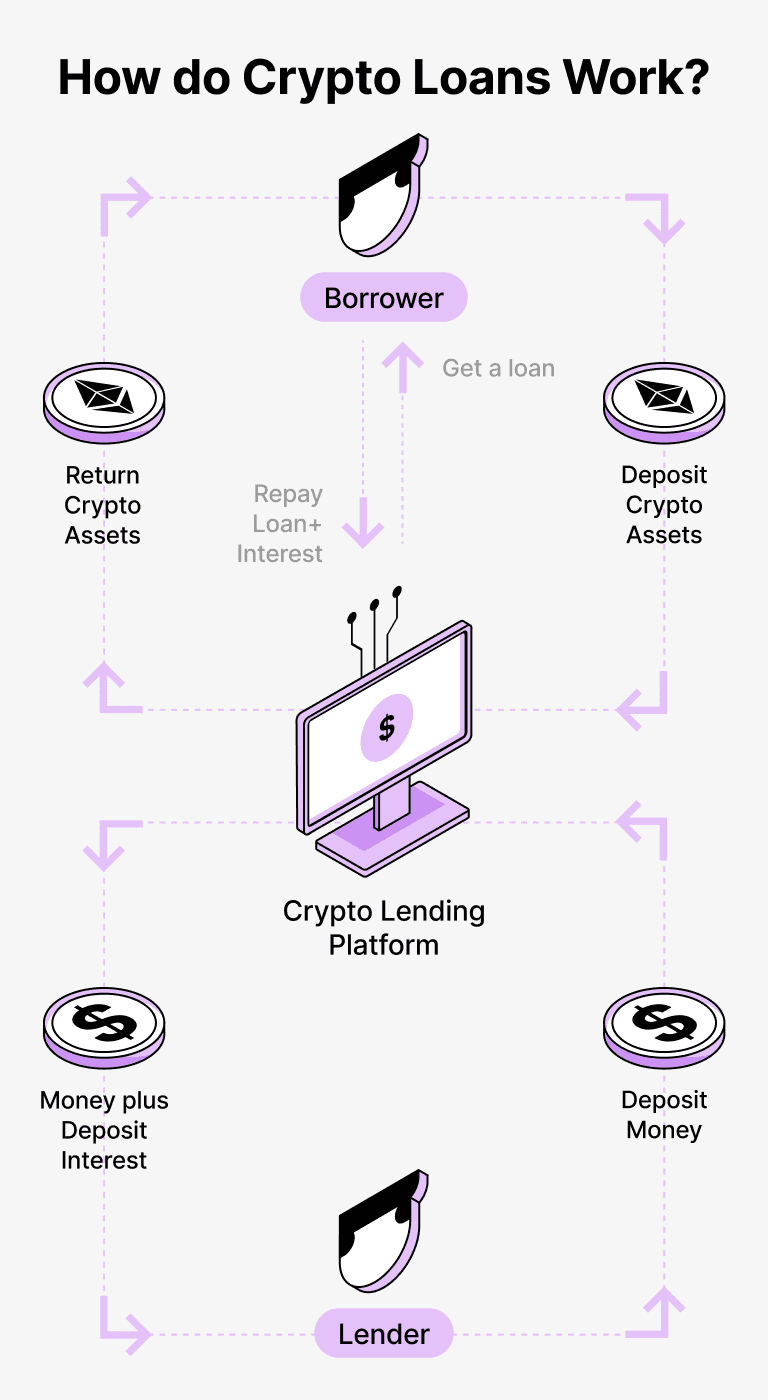

Crypto-financing introduces an efficient model for the lender and the borrower. Borrowers can access loans denominated in USDT by leveraging their cryptocurrency holdings as security, whilst still retaining ownership of their digital assets. Consequently, the process sidesteps conventional credit appraisals and documentation, rendering it quicker and budget-friendly.

Lenders, on the other hand, can pledge their cryptocurrencies such as Avalanche (AVAX), into a dedicated account on Beast. Zeus, the custodian, governs the exchange between lenders and borrowers, championing a secure method. They serve as a trusted mediator safeguarding both parties' interests.

Borrowers gain from this arrangement by accessing funds without offloading their cryptocurrency assets. This utility becomes a lifeline during market volatility as potential losses can be avoided. The lending framework also refines loan procedures, negating the need for credit evaluations.

Lenders' deposited assets generate interest via loan repayments, enabling them to earn from their cryptocurrency holdings. Ultimately, it's a harmonious scenario where borrowers can access loans and lenders can capitalize on their commitment.

Beast's platform manages the liaisons between borrowers and lenders, and the incorporation of blockchain technology ensures secure dealings without third-parties. The overall effect is a reduction in fraud risk, cultivating a safer lending environment.

Avalanche Loan Calculator

Crypto Loans explained

How to get a loan on Avalanche? Borrow usd against Avalanche on Beast

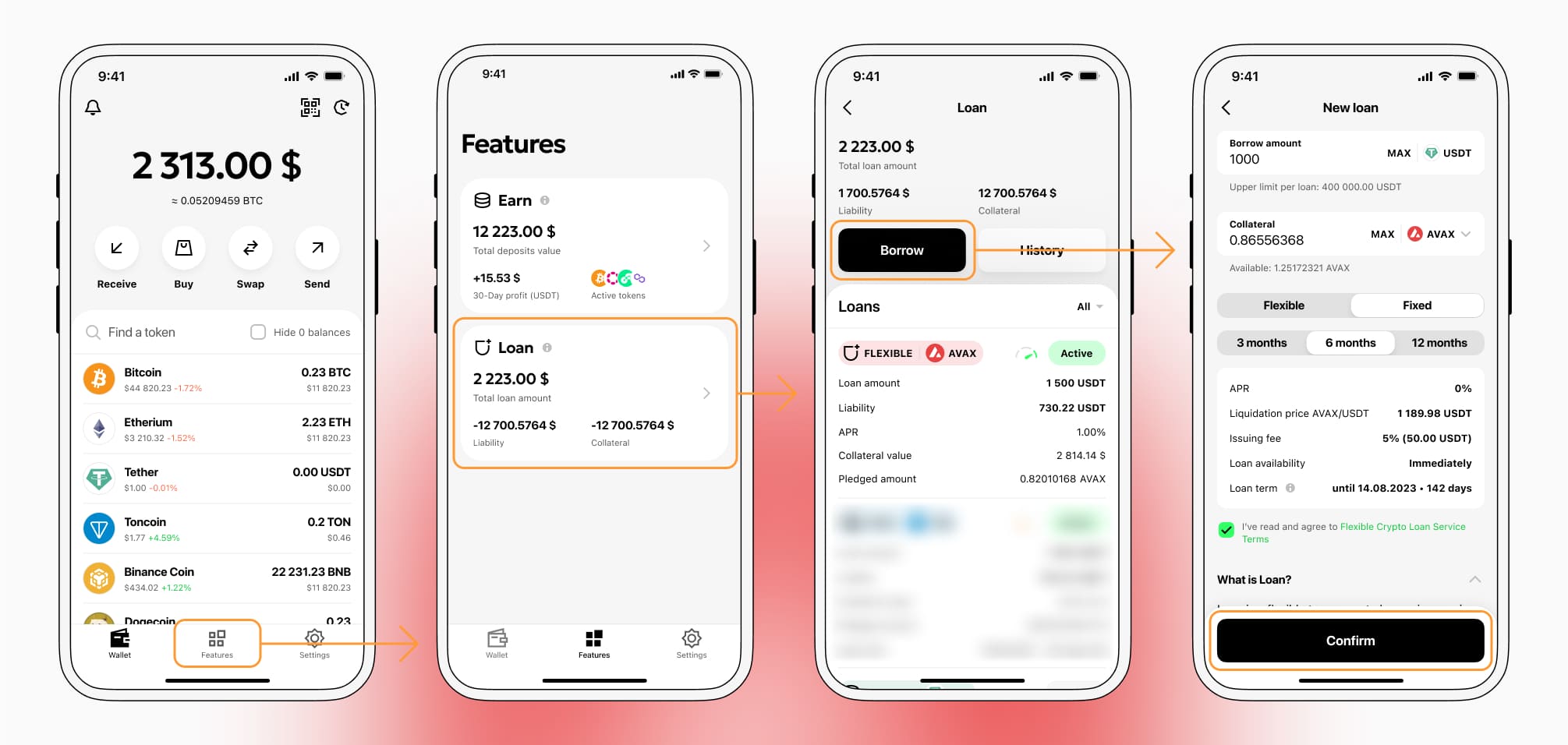

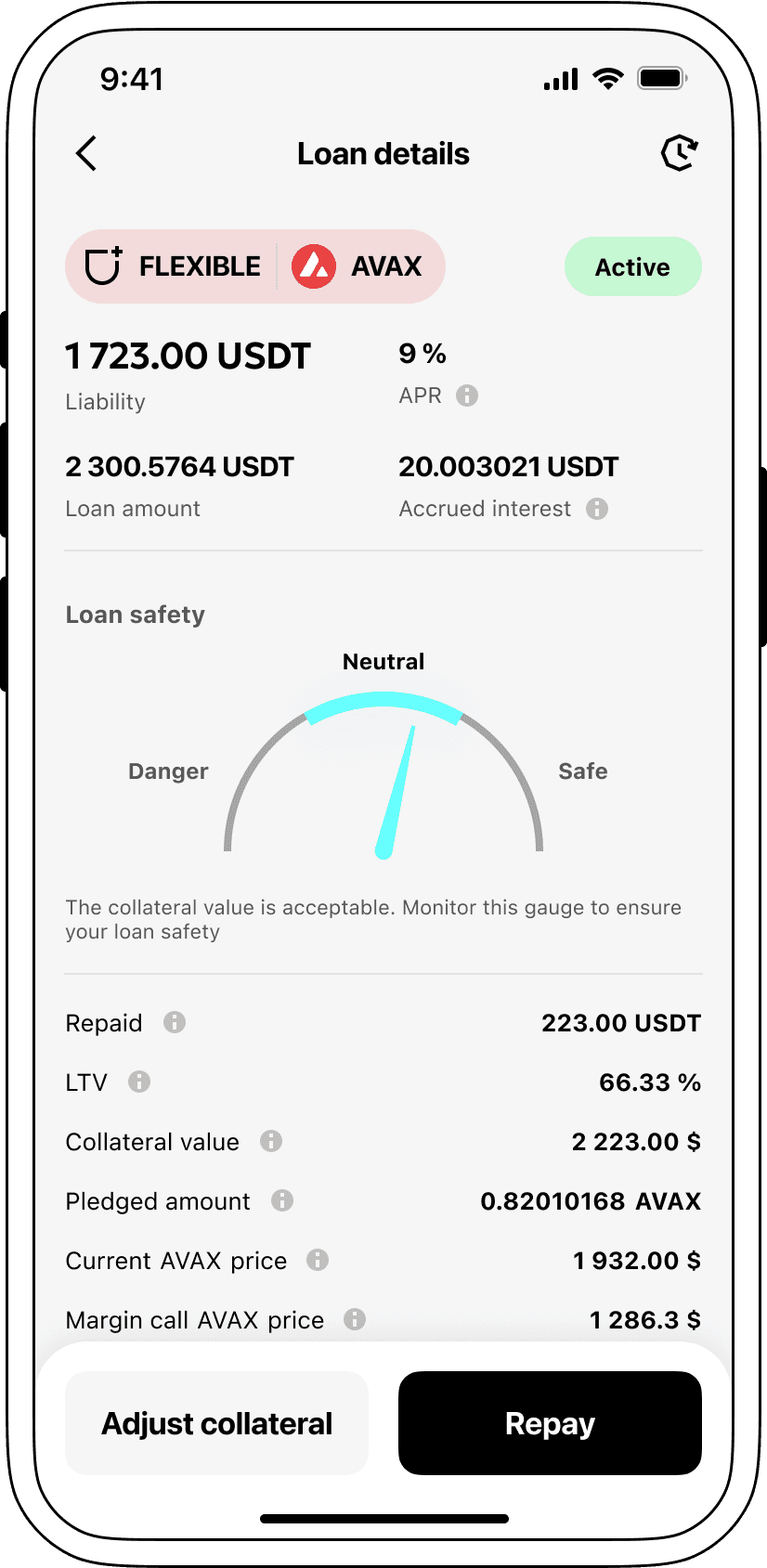

The process of getting an Avalanche cryptocurrency loan is quite simple. First, you need to create your account on Beast, a platform that offers Avalanche cryptocurrency lending services. Then, you need to provide your AVAX as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that Avalanche cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an Avalanche Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about AVAX Crypto Loans

Interest rates for loans secured by Avalanche.

At Beast, we recognize the significance of affordable interest rates. We privilege you to take advantage of loans facilitated by cryptocurrency, enticingly constituted at only 9%. Irrespective of whether you require funds for personal affairs or entrepreneurial pursuits, our loans accompanied by low-interest are optimized for providing a budget-friendly strategy for liquid asset attainment, without necessitating the selling off of your treasured cryptocurrencies.

Beast's cryptographic loans are uniquely distinctive due to their collateralization procedure. Supposing a borrower is unable to fulfill the loan's required payments, the AVAX collateral retained within Beast's secure holding, whilst the USDT Tether originally issued to them remains in their possession. This undertaking ensures an equitable and proportional resolution to circumstances regarding loan recuperation, catering beneficially to both participating parties.

Beast adeptly mitigates risks associated with any potential Avalanche depreciation, administering an automatic liquidation procedure. Upon the collateral's value plummeting beneath a specific limit, liquidation of the loan transpires promptly. This prevents imminent losses from affecting both loaner and loanee amidst market fluctuations.

Furthermore, Beast embodies principles of forthrightness and expediency. Loan product updates are readily accessible to our users via our intuitive interface. In addition, loanee's granted freedoms include extending collateral additions, early loan settlements, or conclusively closing the loan—the sum of the borrowed and the accumulated interest settled.

For individuals curating thoughts on how to solicit a loan utilizing cryptocurrency, Beast delivers immediate coin lending services. This enables users to pledge their Avalanche assets and subsequently procure Tether USDT. Beast's cryptocurrency-underpinned loans offer a prompt and advantageously efficient remedy for your financial quandaries.

Why choose Avalanche Beast Loan

FAQ

What is Beast Avalanche Crypto Loan?

How do I pledge my assets and start borrowing with Beast Avalanche Crypto Loan?

What is LTV, and how much can I borrow from Beast Avalanche Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Beast Crypto Loan?

What can I do with the cryptocurrencies borrowed from Beast Avalanche Crypto Loan?

More coins