Uniswap loans.

Borrow against UNI.

What is Uniswap?

Uniswap is a decentralized exchange built on Ethereum that utilizes an automated market making system rather than a traditional order-book. Instead of matching individual buy and sell orders, users can pool together two assets that are then traded against, with the price determined based on the ratio between the two.

How do loans backed by UNI works

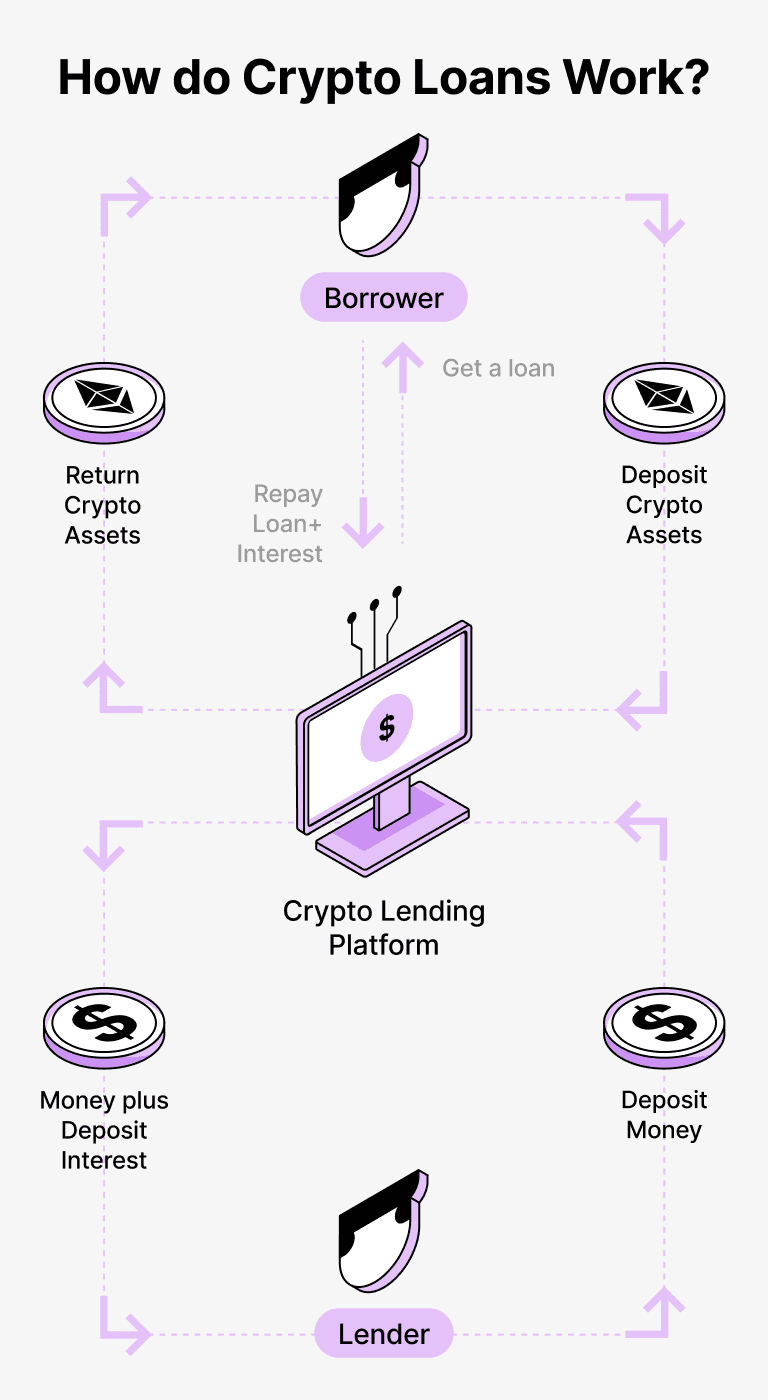

Crypto loans present an easy choice for those borrowing and lending. Borrowers have the option to secure loans in USDT while using their cryptocurrency as collateral, allowing them to retain ownership of their digital assets. This streamlines the process by removing the need for credit assessments and excessive paperwork, resulting in quicker and more affordable transactions.

Lenders can place their cryptocurrency, such as Uniswap (UNI), into a specific account on the Beast platform. A custodian manages all exchanges between borrowers and lenders, ensuring a secure experience. They serve as a reliable intermediary, safeguarding the interests of both parties.

For borrowers, this means they can acquire funds while keeping their cryptocurrency intact. This feature is particularly beneficial during volatile market conditions, helping them evade possible losses. Moreover, this lending system simplifies the borrowing experience, eliminating the requirement for credit checks.

In return, lenders gain interest on their deposited assets through loan repayments. This method allows them to earn from their cryptocurrency holdings. It’s a beneficial arrangement for both sides: borrowers secure loans while lenders reap rewards from their investment.

The Beast platform governs the relationship between lenders and borrowers, while blockchain technology guarantees secure transactions without third parties involved. This lowers the chances of fraud, creating a safer lending atmosphere.

Uniswap Loan Calculator

Crypto Loans explained

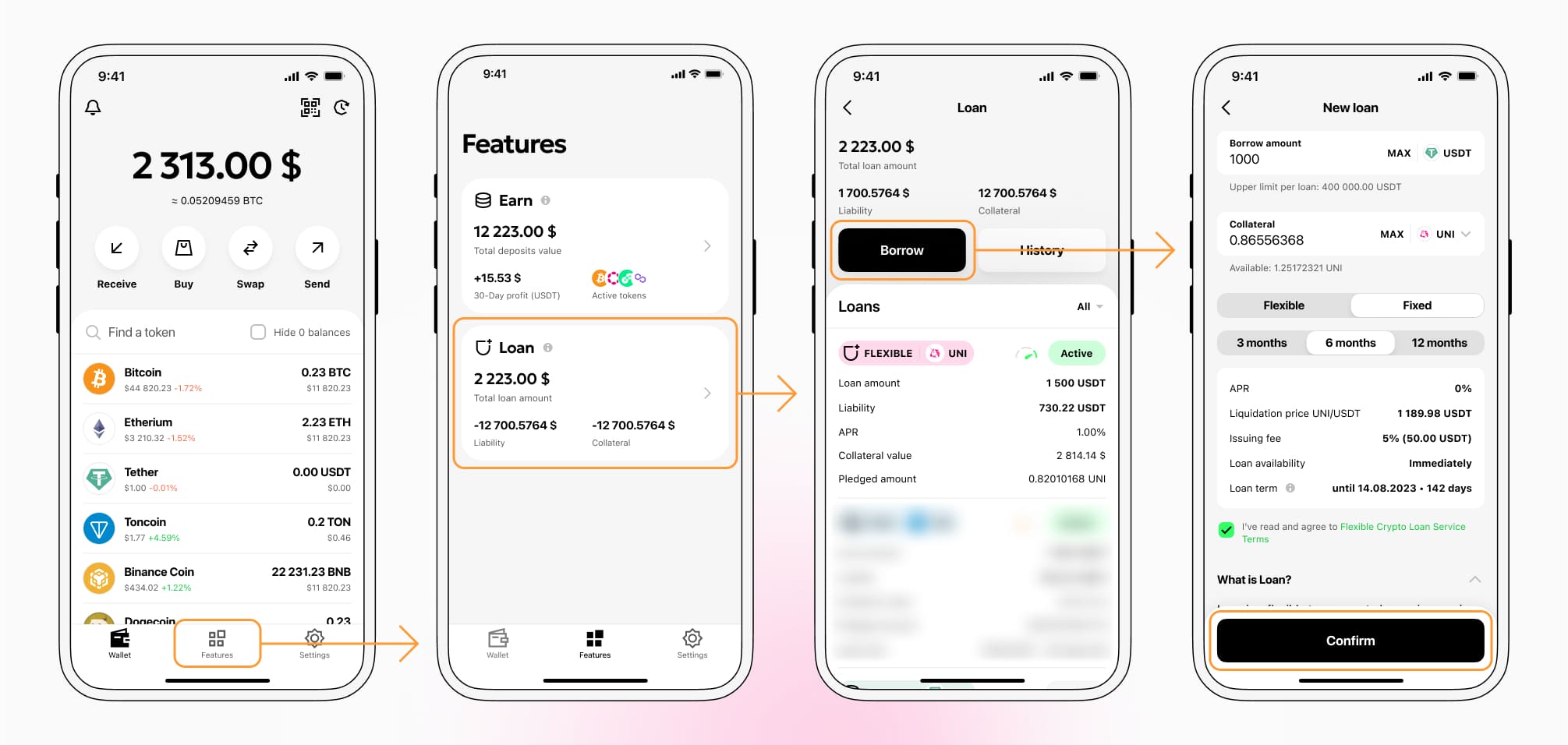

How to get a loan on Uniswap? Borrow usd against Uniswap on Beast

The process of getting an Uniswap cryptocurrency loan is quite simple. First, you need to create your account on Beast, a platform that offers Uniswap cryptocurrency lending services. Then, you need to provide your UNI as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that Uniswap cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an Uniswap Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about UNI Crypto Loans

Loans secured by Uniswap have appealing interest rates.

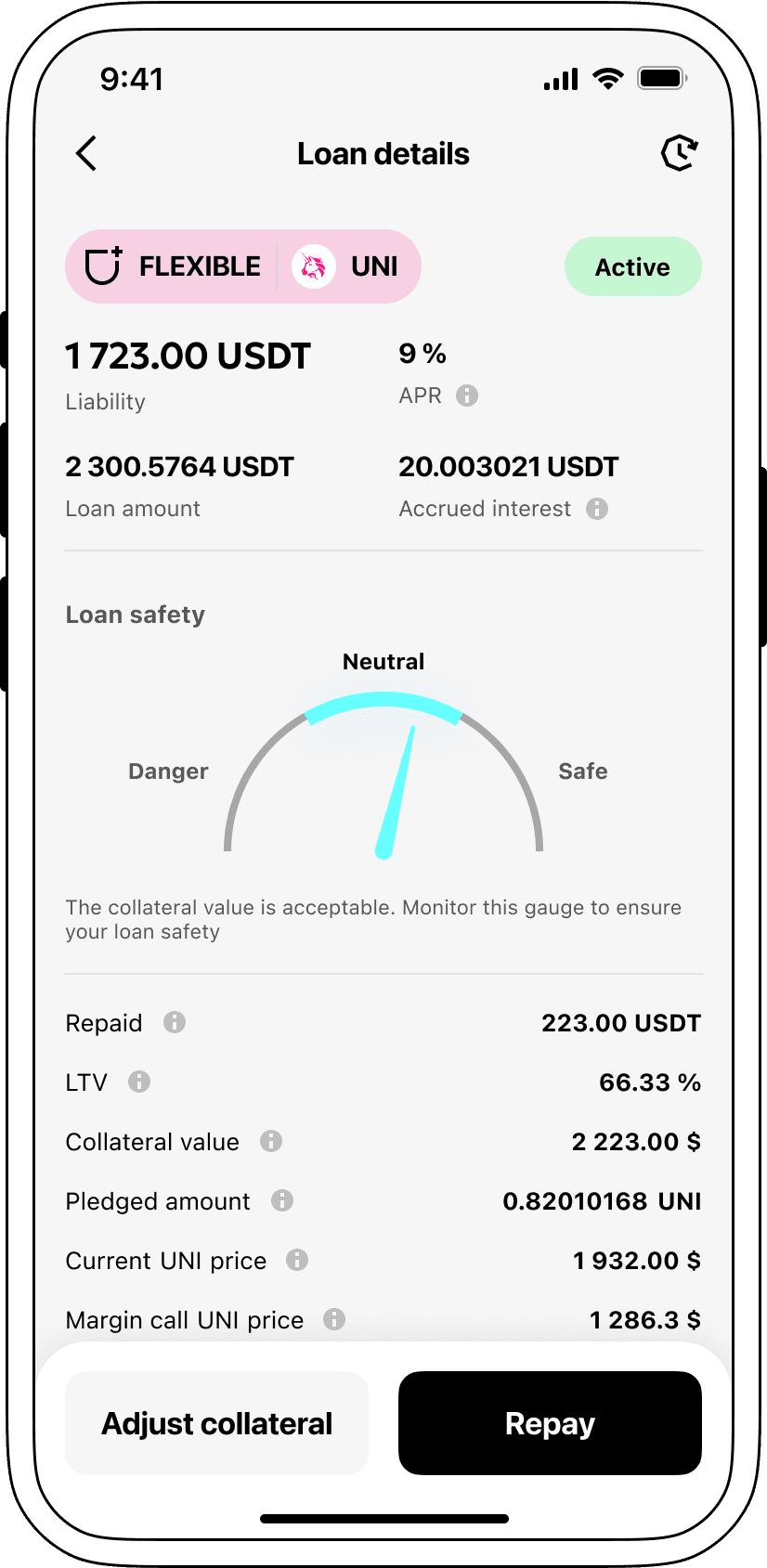

At Beast, we recognize how crucial competitive interest rates are. That's why we provide loans secured by cryptocurrency at an appealing rate of 9%. Whether you require funds for personal use or business purposes, our affordable loans offer an effective way to access liquidity without parting with your prized cryptocurrencies.

A distinctive aspect of Beast's crypto loans is the collateralization method. If a borrower fails to repay the loan, the collateral UNI stays with Beast, while the borrower retains the Tether USDT allocated to them. This guarantees a fair and balanced recovery strategy, which benefits everyone involved.

To mitigate the risk of Uniswap's value dropping, Beast features an automatic liquidation system. Should the collateral's value dip below a set level, the loan will be automatically liquidated. This proactive measure safeguards both borrowers and lenders from potential losses during market declines.

Beast emphasizes transparency and user-friendliness. Our clients can effortlessly track their loan statuses through an intuitive platform. Moreover, borrowers have the option to increase their collateral, pay back the loan early, or settle the loan by paying the borrowed sum plus any interest that has accrued.

If you're curious about securing a loan with cryptocurrency, Beast offers immediate coin loans. You can use Uniswap as collateral and receive Tether USDT. Our crypto-backed loans deliver a swift and convenient answer to your financial needs.

Why choose Uniswap Beast Loan

FAQ

What is Beast Uniswap Crypto Loan?

How do I pledge my assets and start borrowing with Beast Uniswap Crypto Loan?

What is LTV, and how much can I borrow from Beast Uniswap Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Beast Crypto Loan?

What can I do with the cryptocurrencies borrowed from Beast Uniswap Crypto Loan?

More coins