Decentraland loans.

Borrow against MANA.

What is Decentraland?

Decentraland is building a decentralized, blockchain-based virtual world for users to create, experience and monetize content and applications.

How do loans backed by MANA works

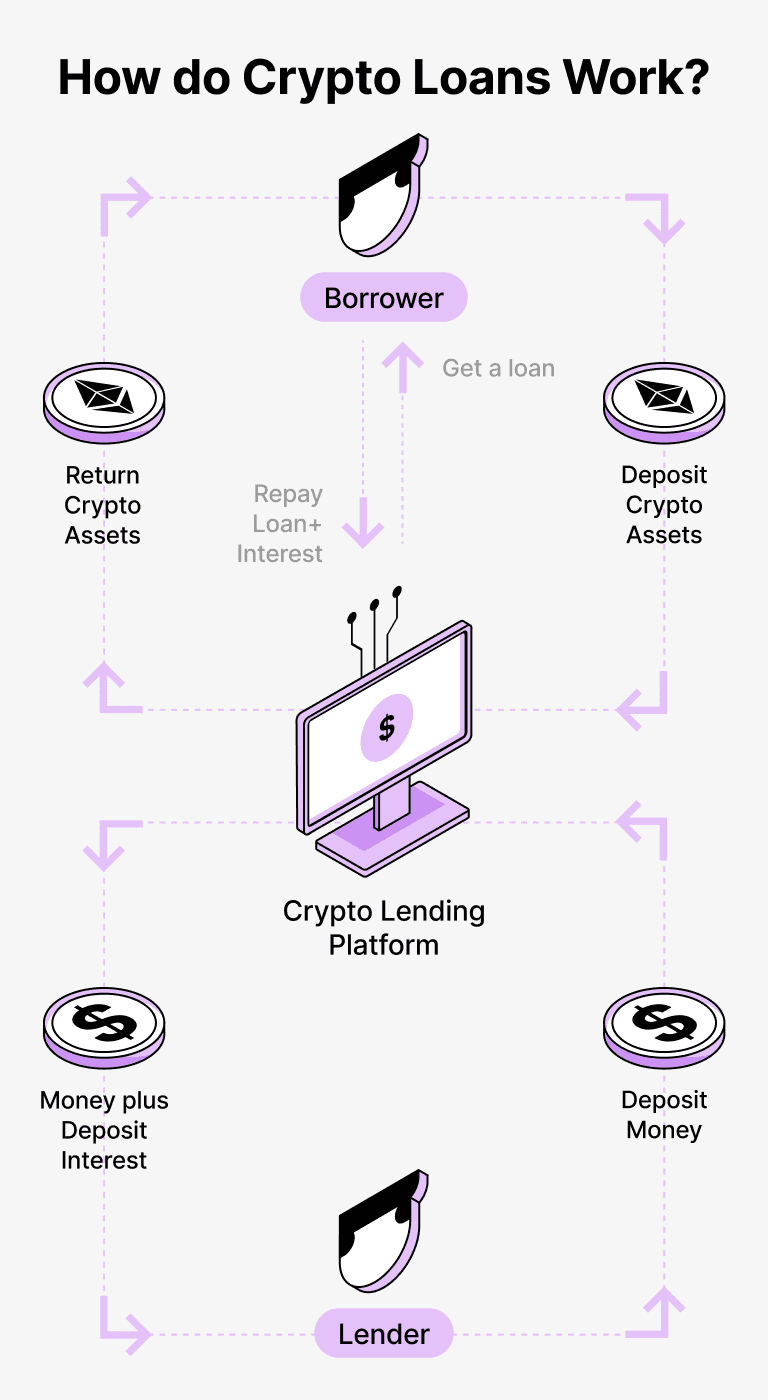

Crypto loans provide an easy option for both borrowers and lenders. Borrowers can secure loans in USDT by putting up their cryptocurrencies as collateral, allowing them to keep ownership of their digital assets. This process cuts out the need for credit evaluations and extensive documentation, resulting in a quicker and cost-effective transaction.

Lenders can place their cryptocurrencies, such as Decentraland (MANA), into a special account on the Beast platform. A custodian manages the connection between borrowers and lenders, ensuring a secure experience. Acting as a reliable intermediary, they safeguard the interests of both parties involved.

Borrowers gain the advantage of accessing funds without having to liquidate their crypto holdings. This is particularly beneficial during market volatility, enabling them to sidestep possible losses. The lending model makes obtaining loans straightforward and bypasses traditional credit checks.

Meanwhile, lenders benefit by receiving interest on their deposited assets through repayments, allowing them to capitalize on their cryptocurrency investments. This creates a mutually beneficial scenario where borrowers secure loans and lenders reap rewards from their contributions.

The Beast platform regulates interactions between both parties, and blockchain technology guarantees secure transactions without the need for third parties. This minimizes fraud risks and fosters a reliable lending atmosphere.

Decentraland Loan Calculator

Crypto Loans explained

How to get a loan on Decentraland? Borrow usd against Decentraland on Beast

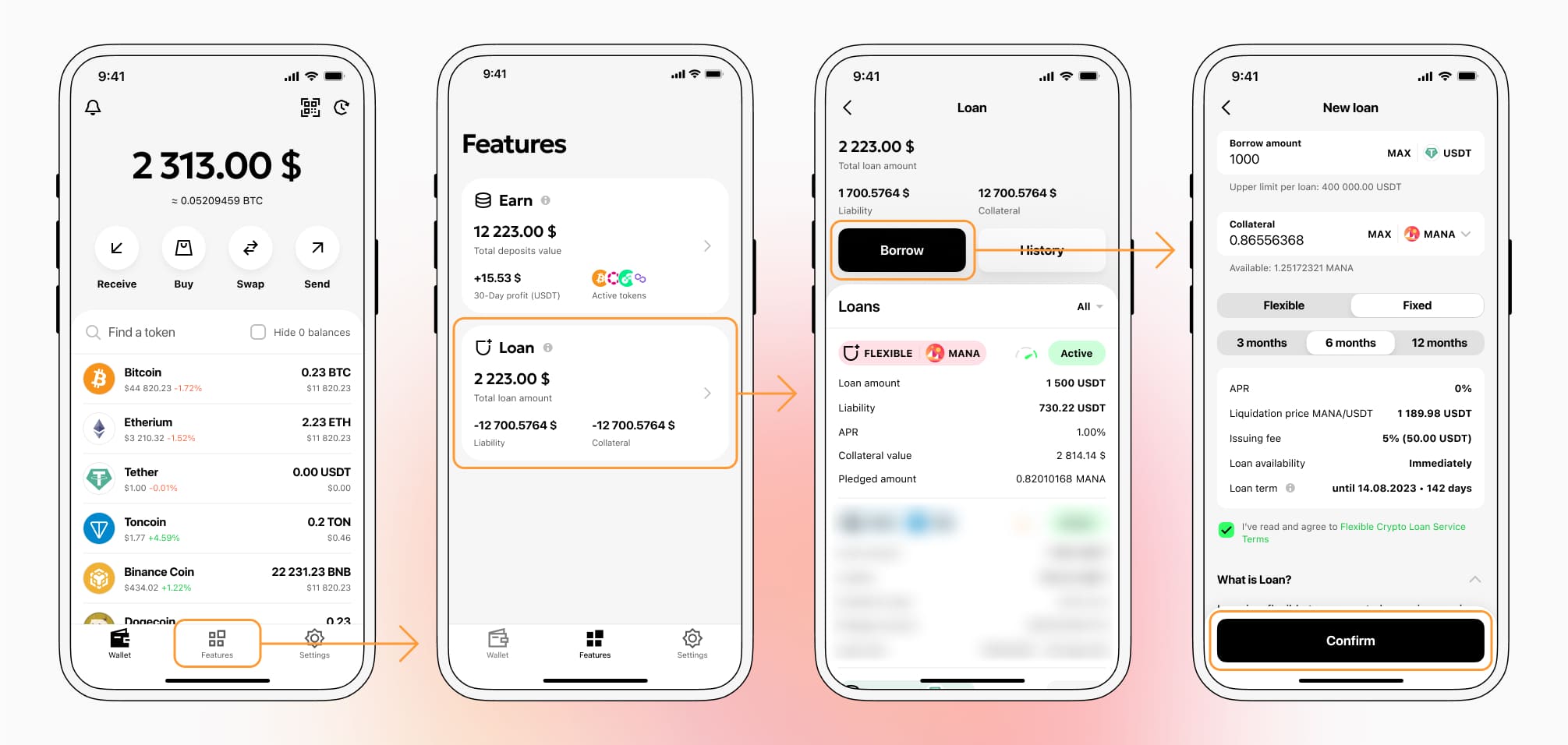

The process of getting an Decentraland cryptocurrency loan is quite simple. First, you need to create your account on Beast, a platform that offers Decentraland cryptocurrency lending services. Then, you need to provide your MANA as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that Decentraland cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an Decentraland Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about MANA Crypto Loans

Interest rates for loans secured by Decentraland.

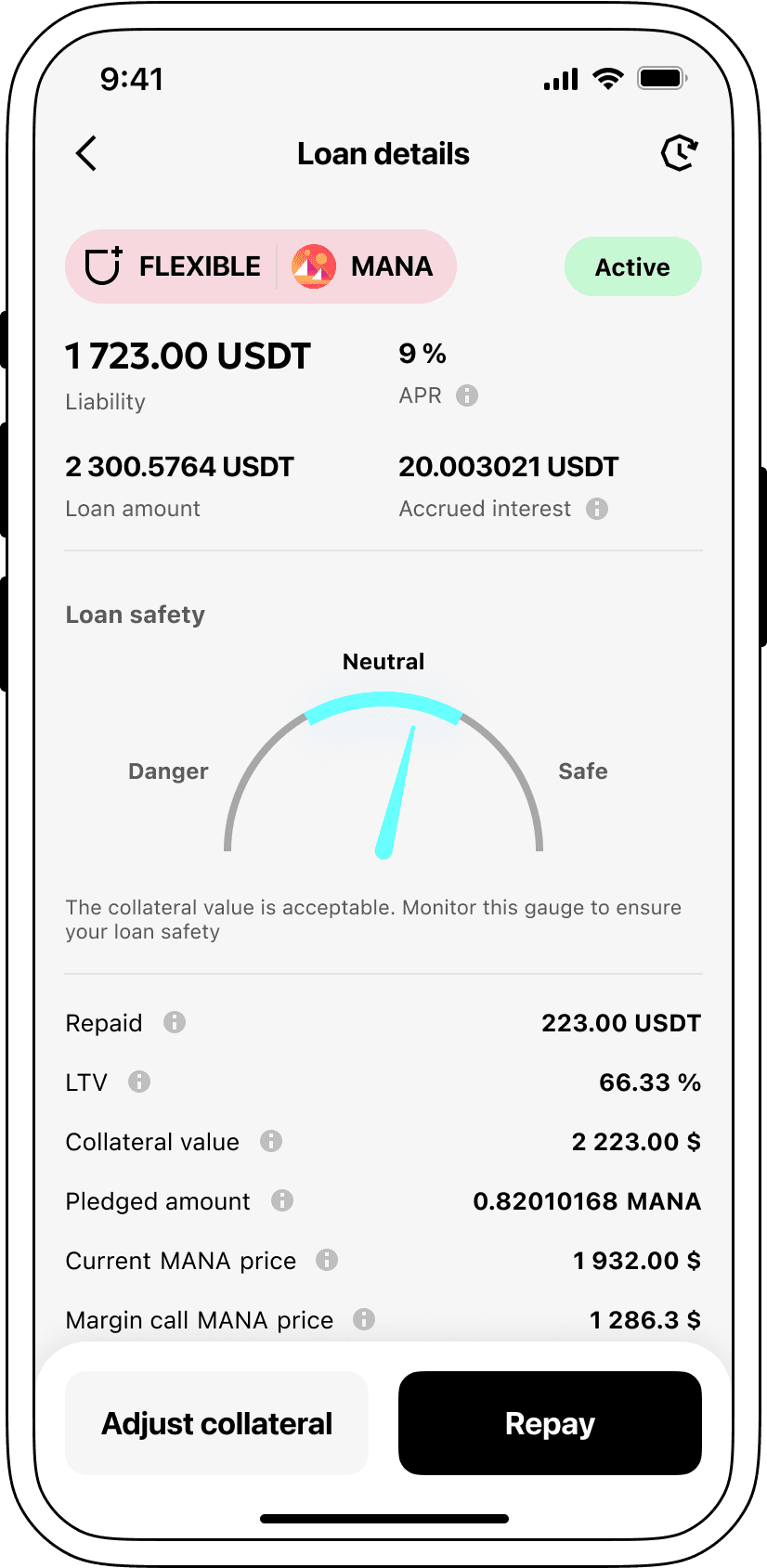

At Beast, we recognize how crucial competitive interest rates are. That's why we provide cryptocurrency loans with an appealing rate of just 9%. Whether you require funds for personal use or business purposes, our low-interest loans are a smart way to access cash without having to liquidate your valuable cryptocurrencies.

One standout aspect of Beast's crypto loans is our collateralization method. If a borrower fails to repay, the collateral MANA stays with Beast, while the borrower retains the Tether USDT they received. This ensures a fair and equitable method for loan recovery, benefiting all involved parties.

To address the risk of Decentraland losing value, Beast has an automatic liquidation system in place. Should the collateral's value drop below a set point, the loan will be liquidated. This proactive strategy safeguards both the lender and borrower from possible losses during a market decline.

We prioritize transparency and ease of use at Beast. Our users can effortlessly track their loan status using our intuitive interface. Furthermore, borrowers have the option to increase collateral, pay off the loan early, or settle the loan by returning the borrowed amount plus any interest accrued.

If you're curious about obtaining a loan using cryptocurrency, Beast offers immediate coin loans. You can borrow against Decentraland to receive Tether USDT. Our crypto-backed loans offer a fast and straightforward solution for your financial needs.

Why choose Decentraland Beast Loan

FAQ

What is Beast Decentraland Crypto Loan?

How do I pledge my assets and start borrowing with Beast Decentraland Crypto Loan?

What is LTV, and how much can I borrow from Beast Decentraland Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Beast Crypto Loan?

What can I do with the cryptocurrencies borrowed from Beast Decentraland Crypto Loan?

More coins