Cosmos loans.

Borrow against ATOM.

What is Cosmos?

Cosmos is a network of sovereign blockchains that communicate via IBC, an interoperability protocol modeled after TCP/IP, for secure data and value transfer. The Cosmos Hub, also known as "Gaia," is a proof of stake chain with a native token, ATOM, that serves as a hub for IBC packet routing among blockchains within the Cosmos network. The Cosmos Hub, like the majority of blockchains in the Cosmos network, is secured by the Byzantine Fault-Tolerant (BFT) Proof-of-Stake consensus algorithm, Tendermint.

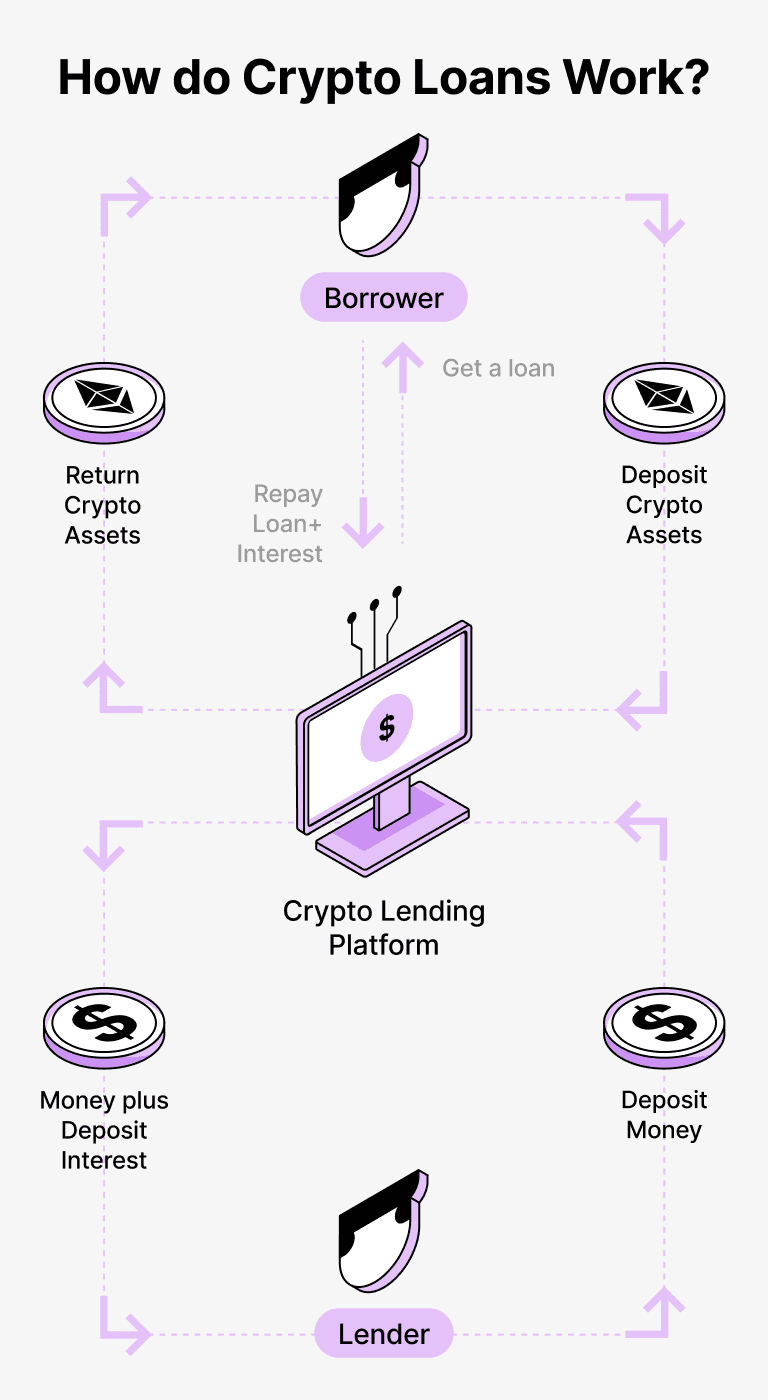

How do loans backed by ATOM works

Cryptocurrency-backed lending offers a convenient alternative for both borrowers and lenders alike. Borrowers leverage their digital currencies as collateral to obtain USDT loans, retaining ownership of their digital assets. This circumvents traditional prerequisites such as credit reviews and paperwork, thus expediting and economical than conventional lending procedures.

Lenders deposit cryptocurrencies, such as Cosmos (ATOM), into an exclusive account within the Beast ecosystem. An account custodian manages all interactions between the borrower and lender, providing a smooth, secure transaction process. They operate as a reliable intermediary, making sure both parties' interests stay safeguarded.

Thanks to this mechanism, borrowers can tap into cash flow without the need to liquidate their cryptocurrency assets. This becomes crucially beneficial in times of market volatility, as potential losses can be circumvented. The lending model further simplifies the loan undertakings and rules out traditional credit assessments.

Lenders, on the other hand, earn passive income through interest obtained from loan repayments, gaining profits from their idle digital assets. Thus, it provides a mutually beneficial setup where borrowers gain access to required financing, while lenders enjoy residual earnings.

Beast platform's regulation of engagement between the two parties coupled with blockchain technology's advantages ensure transactional security independent of intermediaries. This substantially diminishes the potential of fraudulent activities, making it a safe space for lending operations.

Cosmos Loan Calculator

Crypto Loans explained

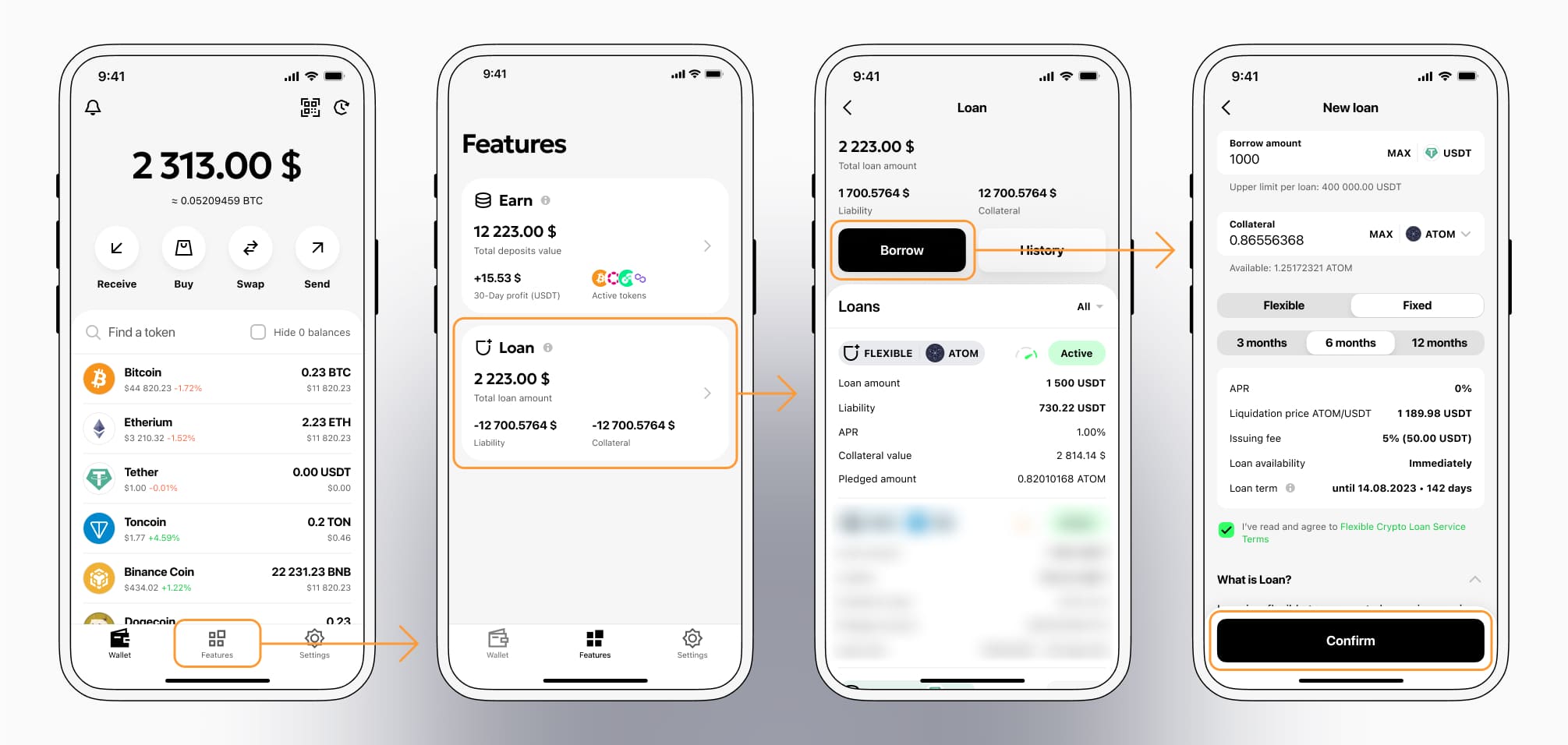

How to get a loan on Cosmos? Borrow usd against Cosmos on Beast

The process of getting an Cosmos cryptocurrency loan is quite simple. First, you need to create your account on Beast, a platform that offers Cosmos cryptocurrency lending services. Then, you need to provide your ATOM as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that Cosmos cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an Cosmos Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about ATOM Crypto Loans

Interest rates for loans secured by Cosmos

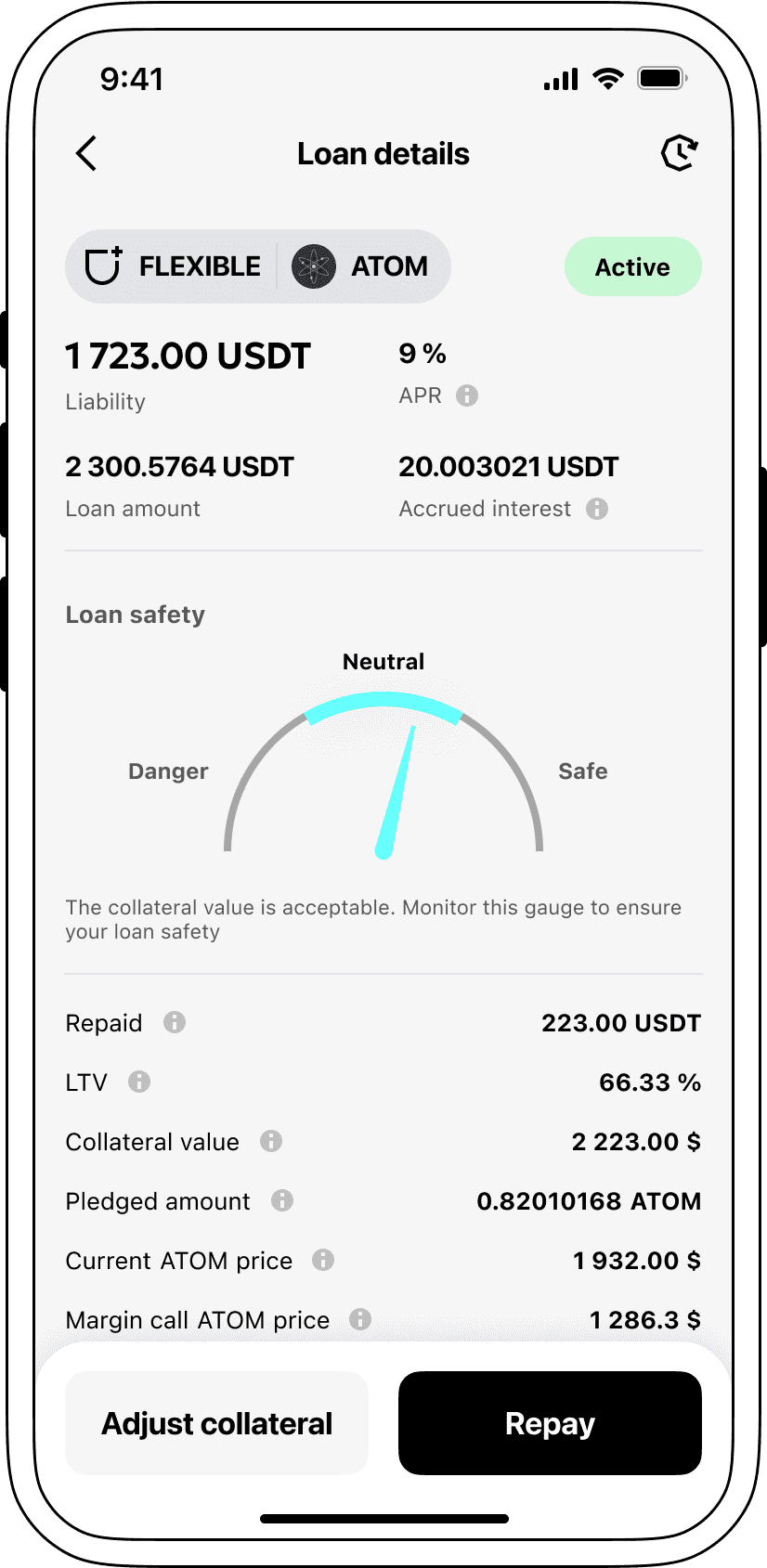

At Beast, we acknowledge the need for aggressive lending offers. Hence, we provide loans secured by cryptocurrency at an unbeaten interest rate of 9%. If you require capital for private or commercial objectives, our low-interest loans represent an affordable strategy to gain liquidity without offloading your precious cryptocurrencies.

A ground-breaking aspect of Beast's crypto loans lies in the collateralization procedure. If a loanee fails to pay back the debt, the collateral ATOM stays with Beast, meanwhile, the borrower retains the Tether USDT allocated to them. This safeguards a justifiable and equitable loan reimbursement process, serving both parties involved.

To counterbalance the risk of Cosmos devaluation, Beast implements an automatic sale mechanism. If the collateral's value degenerates below a crucial limit, the loan will endure liquidation. This preventative practice secure both the lender and borrower from possible declines during a market fall.

Beast prioritizes openness and ease of use. Our customers can conveniently tote up on their loan status via our intuitive dashboard. Besides, borrowers maintain the capacity to increase collateral amount, settle the loan prior to its due, or resolve the loan by reimbursing the borrowed sum, and the corresponding interest.

Curious on how to obtain a loan using cryptocurrency? Beast presents immediate coin loans. Borrow against Cosmos and obtain Tether USDT. Our loans supported by crypto assets offer a rapid and effortless resolution for your monetary requirements.

Why choose Cosmos Beast Loan

FAQ

What is Beast Cosmos Crypto Loan?

How do I pledge my assets and start borrowing with Beast Cosmos Crypto Loan?

What is LTV, and how much can I borrow from Beast Cosmos Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Beast Crypto Loan?

What can I do with the cryptocurrencies borrowed from Beast Cosmos Crypto Loan?

More coins