Catizen loans.

Borrow against CATI.

How do loans backed by CATI works

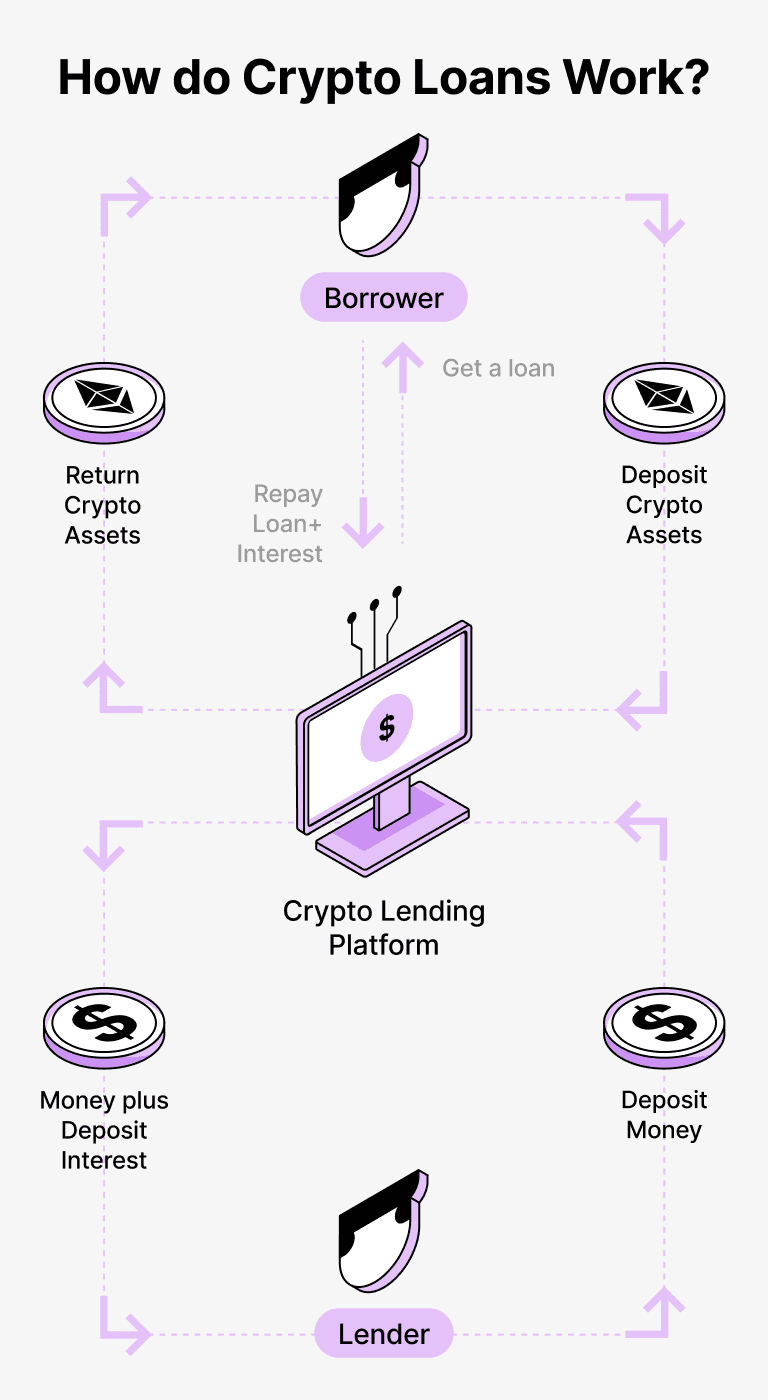

Crypto loans provide a straightforward option for both borrowers and lenders. Borrowers can secure loans in USDT by leveraging their cryptocurrencies as collateral, all while retaining ownership of their digital assets. This method removes the necessity for credit assessments and extensive paperwork, speeding up the entire process and lowering costs.

Lenders can allocate their cryptocurrencies, such as Catizen (CATI), into a specialized account on the Beast platform. A custodian manages the relationship between borrowers and lenders, ensuring a safe and secure environment. They serve as a reliable intermediary, safeguarding the interests of both parties involved.

Borrowers gain the advantage of accessing funds without needing to liquidate their cryptocurrencies, which is vital during market volatility, allowing them to steer clear of possible losses. The lending structure further streamlines the borrowing process, eliminating the hassle of credit checks.

Lenders generate interest on their deposited assets through repayments on loans, creating an opportunity to profit from their cryptocurrency holdings. It’s a beneficial arrangement where borrowers receive loans, and lenders reap the rewards of their participation.

The Beast platform facilitates interactions between borrowers and lenders while leveraging blockchain technology to ensure safe transactions with no intermediaries. This minimizes the risk of fraudulent activities and establishes a reliable lending atmosphere.

Catizen Loan Calculator

Crypto Loans explained

How to get a loan on Catizen? Borrow usd against Catizen on Beast

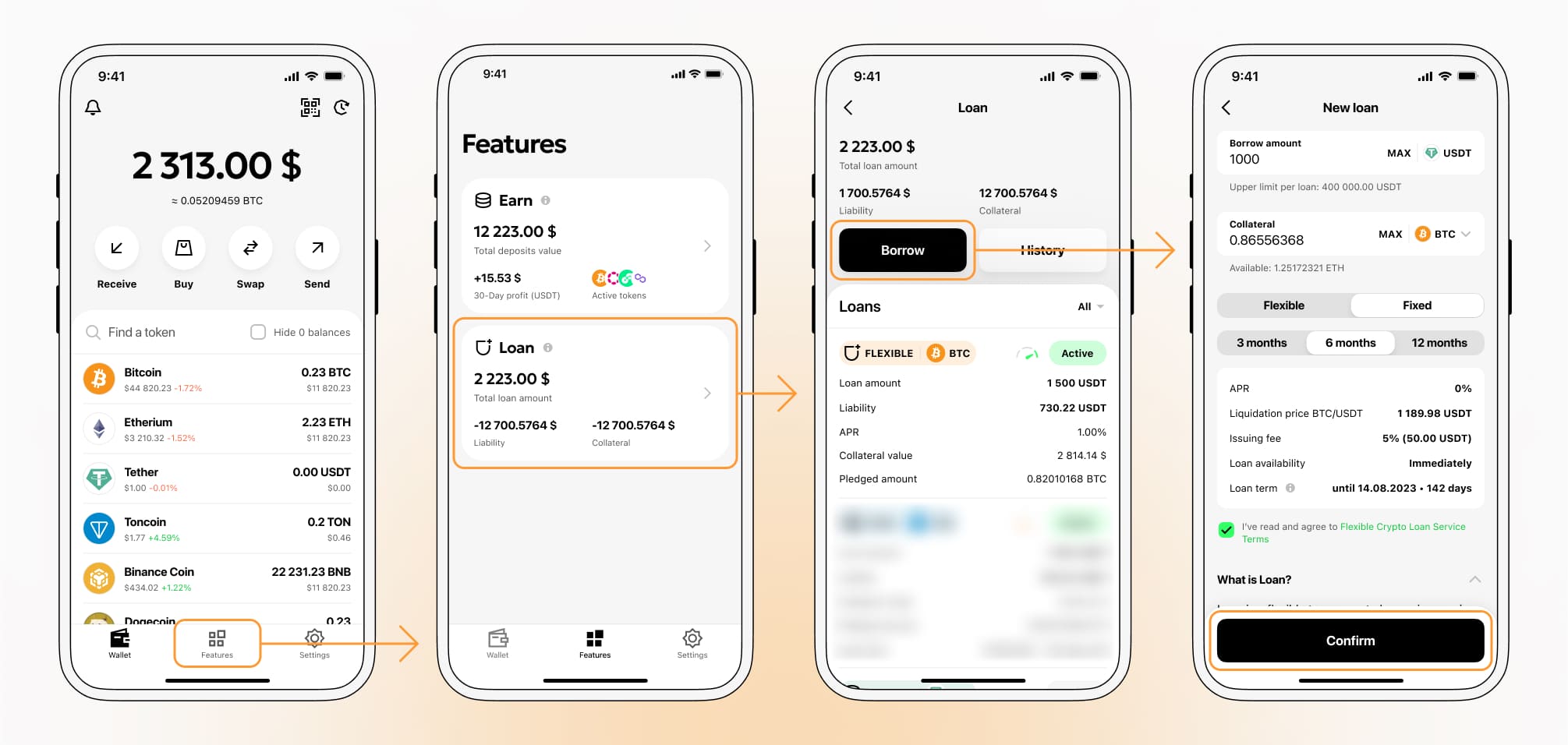

The process of getting an Catizen cryptocurrency loan is quite simple. First, you need to create your account on Beast, a platform that offers Catizen cryptocurrency lending services. Then, you need to provide your CATI as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that Catizen cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an Catizen Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Loans backed by Catizen with competitive interest rates.

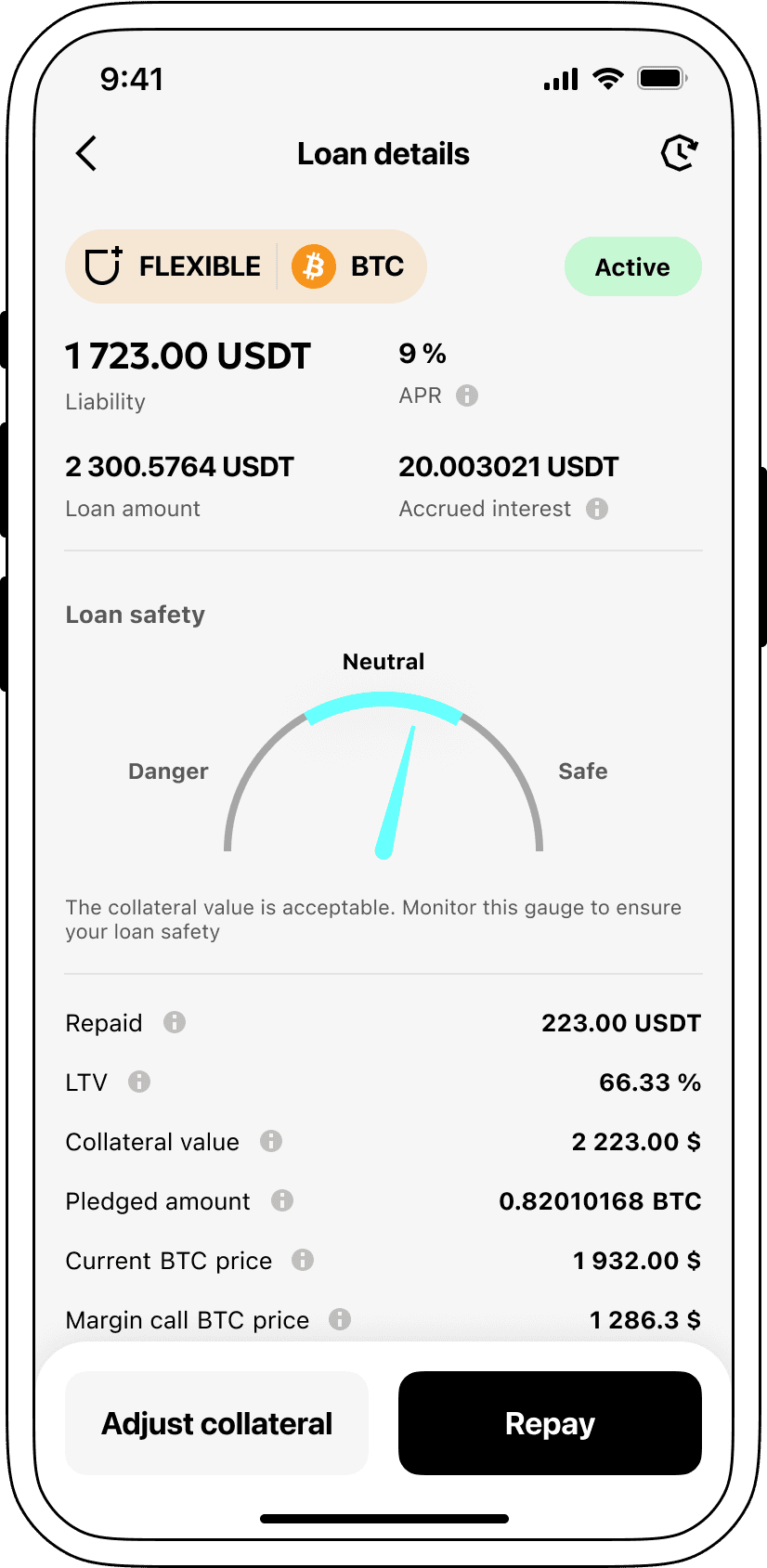

At Beast, we recognize how crucial it is to have competitive interest rates. That’s the reason we provide crypto-based loans with a highly enticing rate of 9%. Whether you're seeking funds for personal or business purposes, our low-interest loans are an affordable way to access cash without the need to sell your valued cryptocurrencies.

One standout aspect of Beast's crypto loans is the collateralization process. If a borrower fails to repay the loan, the collateral CATI remains with Beast, while the borrower retains the Tether USDT they received. This approach ensures fairness and balance in loan recovery, benefiting both sides involved.

To combat the risk of Catizen's value decline, Beast has an automatic liquidation system. If the collateral’s value drops beneath a set level, the loan will be liquidated. This proactive strategy safeguards both the lender and the borrower from possible losses in the event of a market decline.

At Beast, we prioritize transparency and simplicity. Our users can effortlessly track the status of their loans through our intuitive interface. Borrowers can also add more collateral, repay their loans early, or settle their loans by paying back the borrowed sum along with any interest accrued.

If you're curious about securing a loan with cryptocurrency, Beast offers instant coin loans. You can borrow against Catizen and receive Tether USDT. Our crypto-secured loans deliver a fast and convenient solution for your financial needs.

Why choose Catizen Beast Loan

FAQ

What is Beast Catizen Crypto Loan?

How do I pledge my assets and start borrowing with Beast Catizen Crypto Loan?

What is LTV, and how much can I borrow from Beast Catizen Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Beast Crypto Loan?

What can I do with the cryptocurrencies borrowed from Beast Catizen Crypto Loan?

More coins