NEAR Protocol loans.

Borrow against NEAR.

What is NEAR Protocol?

NEAR is a decentralized development platform that uses a Proof-of-Stake (PoS) consensus mechanism and will eventually feature a sharded architecture to scale transaction throughput. Its block generation scheme is called Doomslug and its proposed sharding design is dubbed Nightshade. These technologies will work together to scale the network and minimize congestion. NEAR has also been designed to be developer and user-friendly as it features a few key innovations to accelerate the application development and user-onboarding processes. The NEAR blockchain was created and developed by the NEAR Foundation. Its mainnet went live in April 2020, and network validators voted to unlock token transfers in October 2020. NEAR's bridge to Ethereum (called the Rainbow Bridge) launched in March 2021.

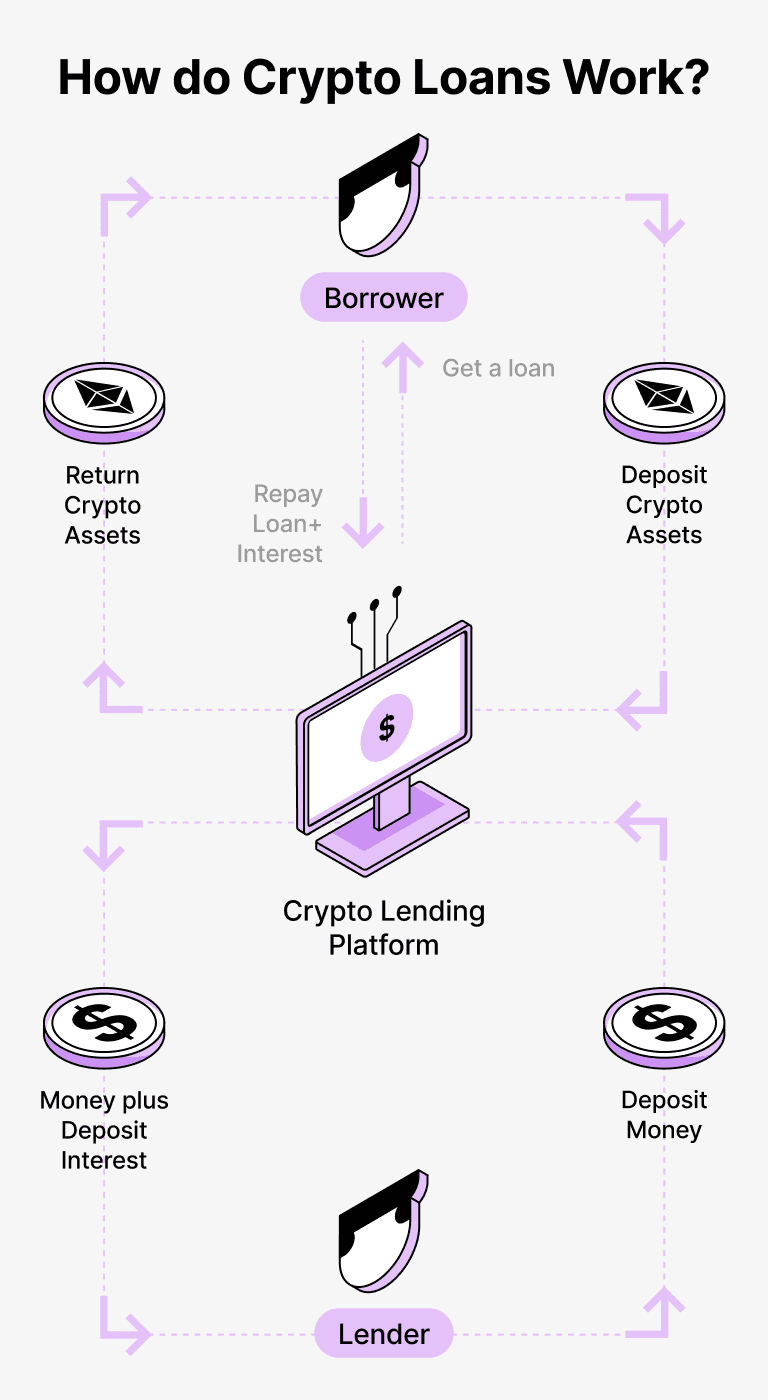

How do loans backed by NEAR works

Crypto loans provide an easy solution for those borrowing and lending. Individuals can secure loans in USDT by using their crypto as collateral while retaining ownership of their digital currencies. This approach removes the need for credit checks and extensive paperwork, streamlining the process and making it more cost-effective.

Lenders have the option to place their cryptocurrencies, such as NEAR Protocol (NEAR), into a secure account on the Beast platform. A custodian manages the connection between borrowers and lenders, ensuring a safe transaction process. Acting as a reliable intermediary, they make sure the interests of both parties are well-protected.

For borrowers, this means accessing necessary funds without the need to liquidate their crypto holdings. It becomes especially valuable during times of market volatility, as it helps to sidestep potential losses. The lending structure further simplifies obtaining loans and eliminates credit checks.

Lenders receive interest on their provided funds through loan repayments, allowing them to earn from their cryptocurrency investments. This creates a mutually advantageous scenario where borrowers obtain loans and lenders gain rewards.

The Beast platform oversees the interactions between borrowers and lenders while utilizing blockchain technology to enable secure transactions without need for middlemen. This setup significantly reduces the risk of fraud and fosters a trustworthy lending atmosphere.

NEAR Protocol Loan Calculator

Crypto Loans explained

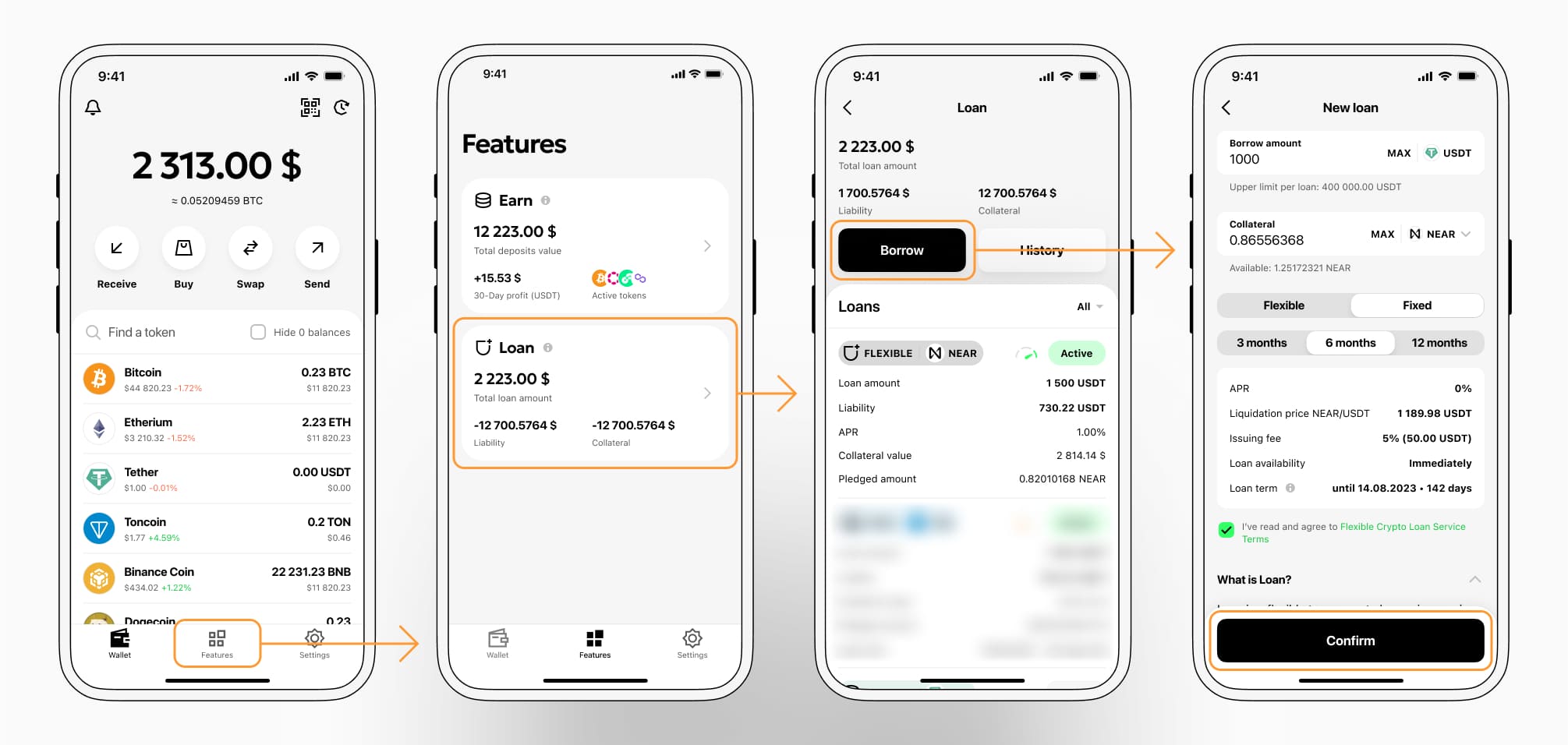

How to get a loan on NEAR Protocol? Borrow usd against NEAR Protocol on Beast

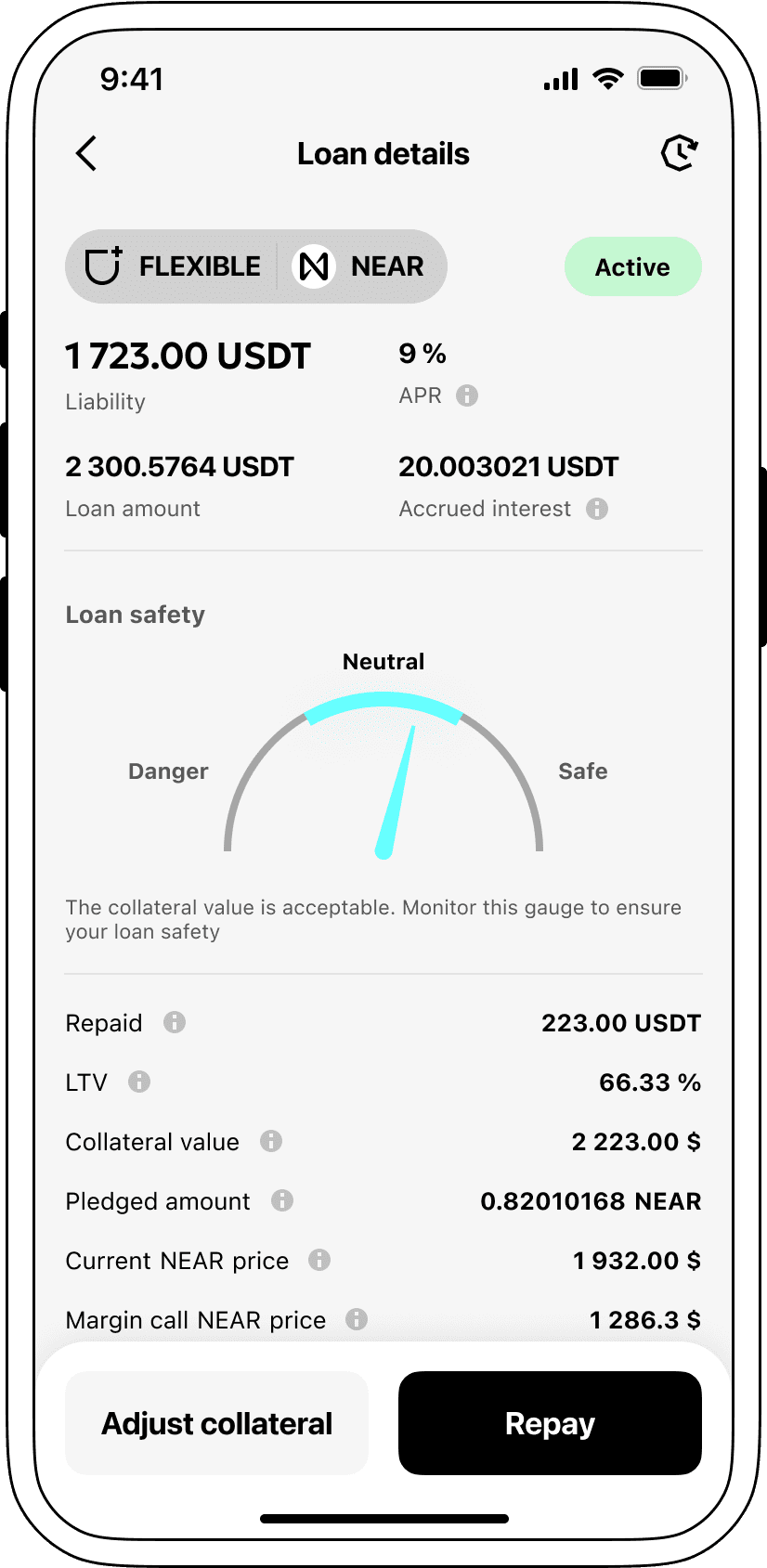

The process of getting an NEAR Protocol cryptocurrency loan is quite simple. First, you need to create your account on Beast, a platform that offers NEAR Protocol cryptocurrency lending services. Then, you need to provide your NEAR as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that NEAR Protocol cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an NEAR Protocol Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about NEAR Crypto Loans

Loans secured by NEAR Protocol feature competitive interest rates.

At Beast, we recognize how essential competitive interest rates are. That's why we provide loans backed by cryptocurrency at a very appealing rate of 9%. Whether it's for personal or business needs, our affordable loans offer an economical way to access liquidity without needing to sell your valuable cryptocurrencies.

A standout aspect of Beast's crypto loans is our collateralization method. If a borrower fails to repay the loan, the collateral in NEAR remains with Beast, while the borrower retains the Tether USDT they received. This creates a just and equitable system for loan recovery, which benefits everyone involved.

To mitigate the risk of NEAR Protocol's value dropping, Beast employs an automatic liquidation system. If the collateral’s worth dips below a predetermined limit, the loan will be liquidated. This forward-thinking strategy shields both the lender and the borrower from possible losses during market fluctuations.

Transparency and ease are priorities at Beast. Our customers can effortlessly track their loan status through our intuitive platform. Furthermore, borrowers enjoy the option to add more collateral, repay their loans early, or close the loan by settling the borrowed amount along with any interest accrued.

If you’re curious about obtaining a loan with cryptocurrency, Beast provides instant coin loans. You can secure funds against NEAR Protocol and receive Tether USDT. Our crypto-backed loans present a swift and efficient solution to meet your financial requirements.

Why choose NEAR Protocol Beast Loan

FAQ

What is Beast NEAR Protocol Crypto Loan?

How do I pledge my assets and start borrowing with Beast NEAR Protocol Crypto Loan?

What is LTV, and how much can I borrow from Beast NEAR Protocol Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Beast Crypto Loan?

What can I do with the cryptocurrencies borrowed from Beast NEAR Protocol Crypto Loan?

More coins